Workers’ Compensation Insurance

Protect your employees and your business

Choose your primary industry to get started:

The best Workers’ Comp insurance can help cover the cost of workers hurt on the job

Medical expenses

Includes examinations, treatments and rehabilitation.**

Lost wages

Gives employees time to recover from an injury before returning to work.

Retraining

Helps employees who need to learn skills and enter a new field after injury.

Permanent injury

Provides benefits for employees who can no longer work due to injury.

Employers liability

Helps protect your business if an employee files a lawsuit for your negligence causing illness or injury.

Survivor benefits

Supports families by helping to cover funeral costs and income replacement.

What is Workers’ Compensation insurance?

Workers’ comp is required business insurance in most states for businesses with employees. Even if it’s not required in your state, it can help cover some of the costs if an employee is hurt on the job or suffers a work-related illness.

Workers’ comp can help protect business owners from significant financial losses, including lawsuits and expenses related to medical costs, lost wages while employees recover, some on-the-job retaining, and costs associated with permanent injury and death.

Without insurance, the employer could be responsible for all related costs, which could add up to tens of thousands of dollars.

How much does Workers’ Comp insurance cost?

Workers compensation insurance policies can cost as little as $14/month for some low-risk businesses.

Several factors influence the price you’ll pay for insurance, including:

- Your industry

- Your number of employees

- The size of your business

- Where you do business

- Your business needs and how much coverage you choose

- Policy limits

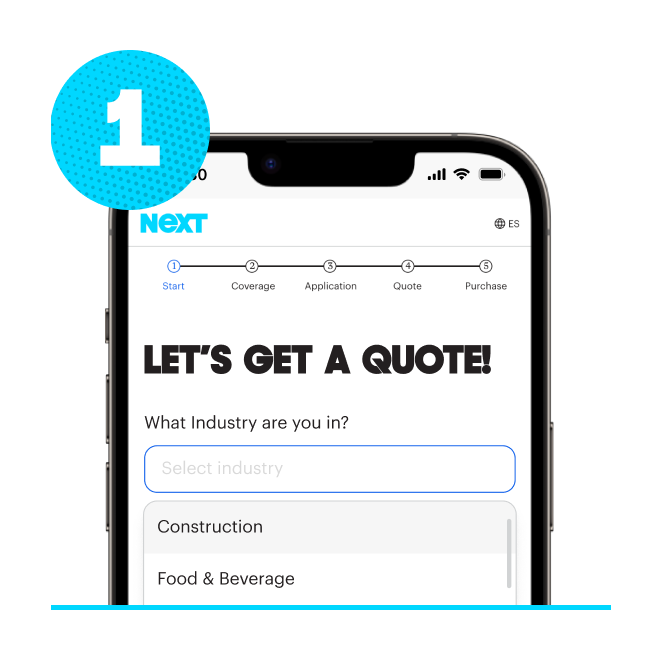

How to get Workers’ Comp insurance

Start a free online quote

In about 10 minutes you’ll see the exact price you’ll pay for workers’ compensation insurance online.

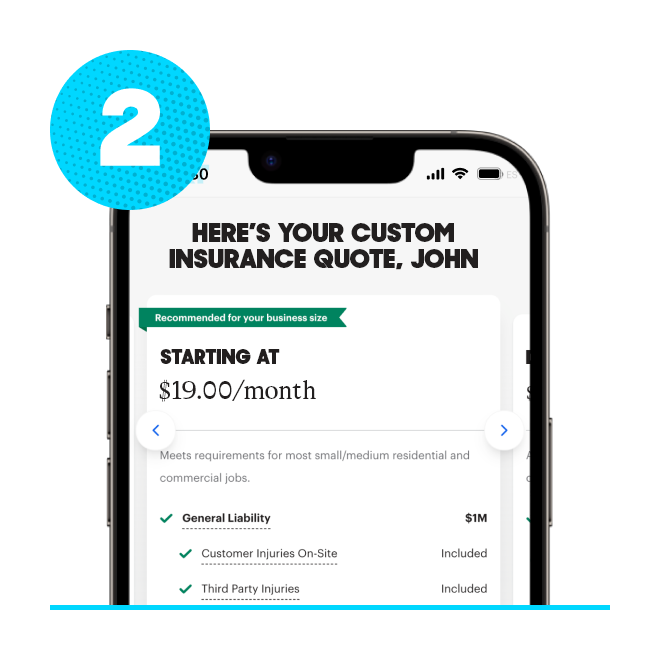

Customize your coverage

Adjust your policy limits and deductibles to pick the right coverage at the right price.

Buy 100% online

Your coverage is effective the next day after payment. And your certificate of insurance is ready at no extra cost.

Who needs Workers’ Comp insurance coverage?

Price calculator

Get an estimate of your business insurance cost

Workers’ Compensation insurance FAQ (frequently asked questions)

Is Workers’ Comp insurance required by law?

Business owners in most states are legally required to have workers’ compensation coverage if they have employees.

Even when it’s not required, many business owners buy coverage for financial protection if an employee experiences a work-related injury or illness. Workers’ comp can also help protect business owners themselves if they add business owner’s coverage to their policy.

Workers’ comp may also be required to get a professional license.

How do I make a Workers’ Compensation insurance claim?

You can file a claim anytime online or in the NEXT app.

You’ll be asked to share the details of what happened and to provide relevant photos and documentation. We strive to make claims decisions as quickly as possible so that you can get back to work.

I'm the owner of the company. Am I covered by my Workers’ Comp policy if I'm hurt on the job?

Injuries to business owners can be covered by optional business owners’ coverage for workers’ comp.

How does Workers’ Compensation insurance work?

Workers’ compensation insurance helps protect employees. It may also help protect your business from paying large out-of-pocket costs for workplace injuries and illness. Employers pay the monthly or annual premium, and in return the insurance company can help cover these costs and mitigate the financial burden on your business. In most states, carrying workman’s comp insurance coverage is a requirement.

Workers’ comp also helps employees. If they’re injured on the job they can focus on their recovery without worrying about the financial implications of their injury and loss of work.

By accepting workers’ comp benefits, injured employees typically waive their right to sue their employer for negligence related to the injury. This legal protection can help safeguard your business from costly and time-consuming lawsuits.

Workers’ comp premiums are tied to payroll. And paying an insurance premium is often more cost-efficient than paying for injured workers or job retraining. For example, a $100,000 salary might cost a few thousand dollars in annual premium. This can be more cost-efficient than hefty medical bills and/or lawsuits that could reach hundreds of thousands or more.

The types of claims on your policy and the compensation for care the injured person can receive vary based on your policy, your location and the nature of the injury. Each state sets its own rules for how much is paid for medical bills based on the type and severity of the injury or illness.

If the injury is bad enough that the employee can’t return to work right away, a loss of income claim could help with wage replacement until they’re able to work.

If an injury is so severe that the employee can’t return to work at all, permanent injury benefits may provide compensation to the employee for the rest of their life.

And worst case scenario: If an employee dies after a work-related illness or injury, the employee’s beneficiaries could receive death benefits to cover some funeral expenses. In addition, the employee’s spouse, children or dependents could receive survivor benefits to help offset the family’s loss of income long-term.

Do I need Workers’ Comp if I’m self-employed?

A common misconception about workers’ comp is that it’s only for businesses that have employees.

In fact, optional workers’ comp coverage for self-employed workers, sole proprietors and independent contractors can provide financial protection and help meet contract requirements with clients.

If you don’t have workers’ comp and you are injured at work, you also might not be covered by your personal health insurance. It’s important to read your policy documents carefully to make sure you are protected.

Who is exempt from Workers’ Compensation insurance?

Every state except for Texas requires workers’ comp for employees.

However, each state also typically has a short list for who is exempt from coverage. It’s important to check the insurance requirements where you work.

Some states don’t require the insurance for certain types of workers, such as:

- Agricultural employees

- Domestic workers

- Real estate employees

- Coaches for children’s sports team

Be sure to check the exemptions in your state.

Do business owners without employees need to buy Workers’ Compensation?

If you’re a business owner without employees, you may not be required by law to have workers’ compensation, particularly if you’re a sole proprietor, partner or LLC member.

However, that might not be the case for more regulated industries, such as construction.

Even if it’s not legally required, you could still be asked by your clients for proof of insurance. A certificate of insurance for workers’ comp lets clients know you have coverage if you get injured while working for them.

Do contractors need Workers’ Compensation insurance for themselves?

If you’re a sole proprietor or independent contractor without any employees, you usually aren’t required by law to get workers’ comp.

However, the construction industry is often regulated differently and you might be required to have coverage before you take a job.

Regardless if it’s required by law, it can be a good idea to have an active workman’s comp policy. If you get sick or injured on the job, workers’ comp can help cover medical bills and some of your lost wages.

If you’re a sole proprietor or independent contractor with employees, you may need to get workers’ compensation for them.

Does Workers’ Compensation cover business interruption?

Workers’ compensation does not cover business interruption.

Business income interruption is a type of property insurance that covers the loss of income that a business suffers after an unexpected event, such as a fire or snow storm. It’s included in NEXT’s commercial property insurance coverage.

Does Workers’ Compensation cover subcontractors?

Workers’ compensation policies generally do not cover subcontractors because they’re not your employees.

However, in some states for some industries, subcontractors may be classified as your employees if they don't carry their own workers compensation. In that case, you must report their payroll as your employees.

What’s the difference between Workers’ Compensation and disability insurance?

Workers’ compensation provides financial help for injuries that happen at work or work-related illnesses.

Disability insurance usually covers injuries that happen outside of work.

It’s the employer’s responsibility to pay for workers’ compensation insurance, and it’s usually required by law.

Disability insurance is typically optional and costs are often shared between the employer and employee.

Learn more about the differences between workers’ compensation and disability insurance.

Does Workers’ Compensation pay disability benefits?

Workers’ comp benefits are separate and distinct from disability benefits.

If a work injury results in a permanent injury that renders an employee unable to return to work, workers’ comp can pay some permanent injury benefits, but it varies by state.

A workers’ compensation doctor must verify and rate your disability, and verify that your disability was caused by work.

Is Workers’ Compensation different from health insurance?

Workers’ comp can help with medical expenses and lost wages after an accident or illness on the job.

Health insurance usually covers personal injuries and ailments that happen outside of work.

Learn more about the differences between workers’ comp and health insurance.

When will I get my policy and proof of insurance?

It takes about 10 minutes to get a quote and buy coverage online. Your policy kicks in the next day and you’ll have full access to policy documents and your certificate of insurance (COI) at no extra charge.

You can access your documents and COI 24/7 online or in the NEXT app for iPhone or Android.

Compare Workers’ Compensation insurance

Learn how workers’ comp stacks up against other insurance coverages:

Get customized insurance wherever you do business

Learn more about workers’ compensation insurance options in the state where you work.

NEXT Insurance reviews

General Insurance & Worker's Comp

The service I've received from Next is great. I am looking forward them adding automobile policies to the roster.

Samuel B.

Very easy to do business with!

Next is very easy to do business with. The sign up was easy, the payment system is fast and easy and they are reasonably priced.

Dainer B.

Company insurance

They got me several quotes within three minutes and I picked one and had my policy in place in the next few minutes I will always use them for all my insurance needs!

Dana R.

Easy fast coverage

It was easy to sign up. The price was right. I was able to email a certificate within minutes.

Russ D.

GL and workers comp

Fast reliable company with very competitive pricing

Nicholas S.

Thank you for making it

Thank you for making it so easy

angelo r.

Easy as pie

They had coverage for me in less than 15 mins. East to do. Awesome

Richard R.

Peace of mind

easy to apply and and customer service is very responsive

Darrell W.

Excellent

Good service, great prices for the coverages.

Chad S.

Simple and fair

Professional and easy

michael p.