What is professional negligence?

When professional service providers — think architects, accountants and management consultants — don’t do their job as a client anticipated, clients may seek legal recourse for professional negligence. If this happens to you, let your liability insurance company know immediately.

The idea of what’s “an appropriate level of care” is what’s behind most allegations of professional negligence, and oftentimes a financial loss is often involved. If a service provider fails to act with an appropriate level of care in their performance of professional duties, injured clients may turn to the legal system.

For instance, accountants and lawyers have to comply with state laws and regulations, and also with accounting and legal board standards. If they violate these laws, they could be asking for trouble.

Client expectations can also lead to professional negligence allegations. Professionals often get a signed statement of work or a project agreement before beginning a project. The document lists deliverables, process, deadlines, costs and other details. If a client feels you’ve deviated from the document, they could think you’re being negligent.

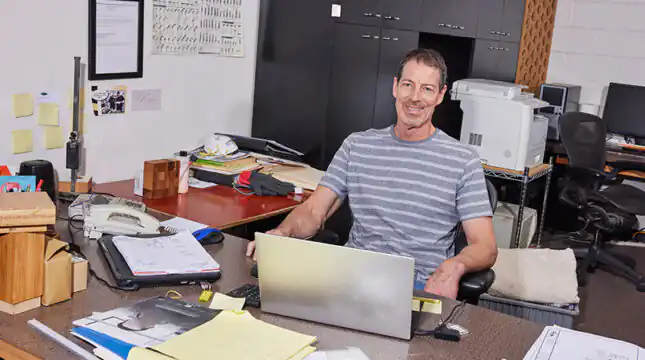

How professional negligence insurance can help

If you’re a professional service provider, professional liability insurance can help protect your business against lawsuits that allege negligence.

Professional liability insurance is a specific form of liability insurance (coverage that protects you against third-party lawsuits). It can help transfer some of your legal risks to an insurance company.

What risks are we talking about? The possibilities are broad. However, your insurance will generally kick in when customers or clients allege that you failed to:

- Meet a professional standard of care, causing them to suffer a financial loss.

- Deliver a service on time or in the format specified in your project agreement.

- Submit complete and high-quality work that the client can use without modification.

- Adhere to the terms of your contract, violating process requirements or other important terms and conditions.

- Act in accordance with all applicable laws, regulations and professional standards.

If these or other problems occur, clients could sue you for damages. If your professional liability insurance covers the incident, your policy could help pay some costs, including:

- Attorney fees

- Court costs

- Expert witness fees

- Plaintiff settlements

- Court judgments (orders) to pay damages

Examples of professional negligence

Professional negligence occurs in many different ways across different professions. Here are some common examples:

Architects and engineers

- Designing plans that violate local building codes.

- Drafting plans for a house or building without adequate foundation support.

- Insufficient plans to demolish and rebuild a structure.

Accounting professionals

- Underreporting state or federal taxes.

- Submitting an incomplete or incorrect tax return.

- Failing to apply for relevant tax credits.

- Not preparing financial statements correctly.

IT consultants

- Specifying the wrong hardware or software that creates production bottlenecks.

- Failing to properly assess a firm’s cybersecurity risk.

- Improperly managing a system upgrade.

- Failing to design a database properly.

When mistakes like these trigger client litigation, professional liability insurance can lessen the financial impact on those who made the mistake. Professional liability is often a claims made policy, which means you must have a policy in effect before an incident occurs and when the claim is made for help to be available.

8 tips to help prevent professional negligence

1. Start with a solid contract

Don’t start work with a handshake. Always define project scope, deadlines and costs with a detailed written contract. Consider hiring an attorney to review your current contract template.

2. Know the law

If you’re in a regulated field, know the law and regulations that govern your business. But don’t stop there. Carefully track the professional bodies that create standards and guidelines in your state. Upgrade your business practices as standards evolve.

3. Manage client expectations

The old saying “under-promise, but over-deliver” is true. Set realistic client expectations for the timing of your work. Don’t promise deliverables if you’re not 100% confident in your abilities.

4. Document every element of a project

Record every development along the way. Phone calls, changes in direction, correspondence, emails — all should be saved electronically or on paper in case a dispute arises later. Pay special attention to mid-course scope or budget changes. Make sure to note the client’s approval of changes so that if a problem surfaces, you have a record of the conversation..

5. Remain in your wheelhouse

It’s always appealing to take on a new project, especially if it’s a big-ticket revenue item. But if a new job isn’t in your specialty area, consider taking a pass. Why? Because if you agree to a job that you’ve never done before, you’ll expose yourself to a higher risk of making a mistake. This is especially true if the completion date is aggressive. It’s better to walk away than open yourself up to negligence charges.

6. Update clients frequently

Always keep clients informed of project status. If you’re running late, inform them and explain why. If you make a mistake, be upfront about the cause. You never want an incident to catch a client by surprise.

7. Become a professional student

Remain up to date with the best practices and technologies in your discipline to reduce getting blindsided during a project. Knowing your stuff is the ultimate negligence repellant.

8. Enforce strict billing practices

Don’t work for free. Collect payment in advance or according to a clearly defined schedule of payments. Many professional liability disputes and lawsuits arise after a professional tries to collect on an unpaid bill. If the project is complete, you have less leverage to get paid.