What is Business Personal Property insurance?

What can Business Personal Property insurance cover?

- Business gear ruined by fire, water, wind or hail at your business**

- Business goods stolen from your store

- Damage to machines, kitchen equipment or computers

- Replacement of ruined furniture, flooring and fixtures

- Equipment failures and inventory loss

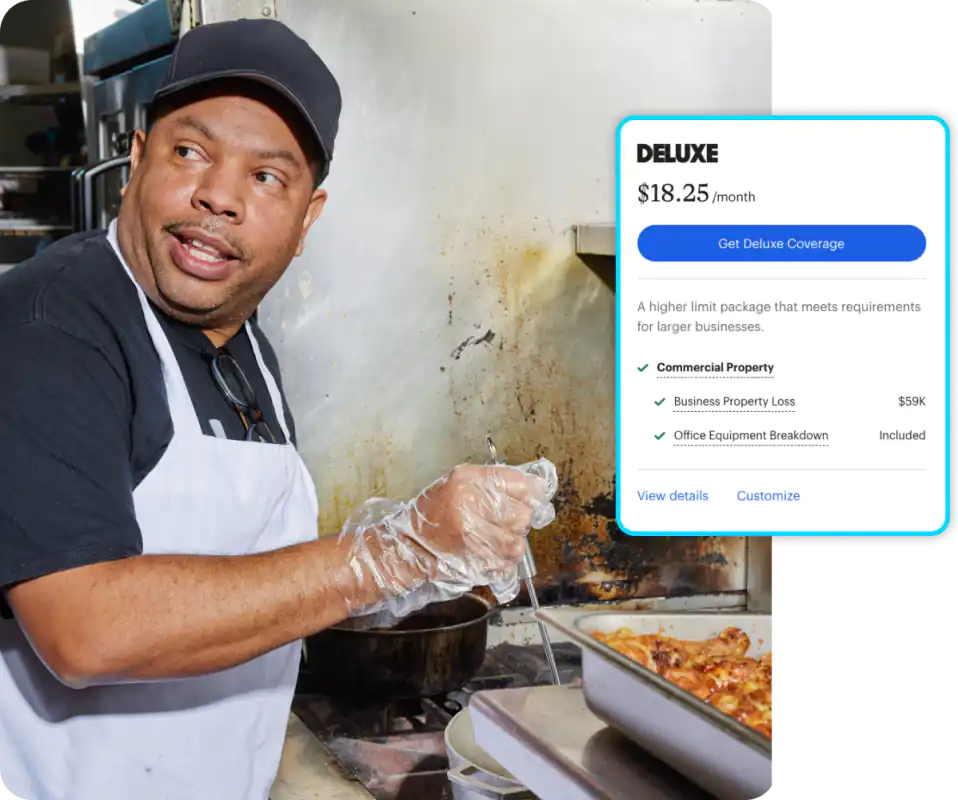

How much does Business Personal Property insurance cost?

Starting at $18/month†

Buy online in about 10 minutes, and cancel anytime.

Who needs BPP insurance most?

- Stores that sell physical products

- Offices with laptops and furniture

- Storage spaces that warehouse products and inventory

- Specialized service gear industries like gyms or salons

Business Personal Property insurance could help protect your business goods and gear, including:

Damaged business equipment

Supplies such as computers, monitors, printers or POS devices located at your business.

Ruined inventory

The merchandise in your stockroom, such as clothing, books, jewelry or food.

Broken tenant glass

Repair or replacement for storefront windows and display cases.

Destroyed business furniture and displays

Office or storefront chairs, desks, tables and artwork.

Damage to upgrades and custom fixtures

Custom lighting, built-in cabinets, bespoke shelving or other permanent renovations you paid to install.

How much does Business Personal Property insurance cost?

BPP insurance is a part of commercial property insurance coverage at NEXT, and it starts at just $18/month† for some low-risk businesses. Business personal property coverage is not sold as a standalone policy.

The exact price your business would pay depends on several factors, including:

- The type and size of your business

- How much equipment and inventory you have

- How much coverage you choose

- Your insurance history

- The state where you work

How to get a Commercial Property insurance online quote with BPP coverage

Start a free online quote

In about 10 minutes you’ll see the exact price you’ll pay for commercial property insurance online.

Customize your coverage

Adjust your policy limits and deductibles to pick the right coverage at the right price.

Buy 100% online

Your coverage is effective immediately after payment. And your certificate of insurance is ready at no extra cost.

Who could benefit from BPP insurance the most?

Retail shops

If the sprinklers fail inside a retail store and destroy inventory, BPP insurance could help cover the costs of soaked furniture, computers and light fixtures.

Restaurants and food services

Business personal property insurance coverage could help cover costs if an electrical outage malfunctions your restaurant freezers and spoiled food inventory has to be replaced.

Cleaning and janitorial services

An accidental building fire destroys all the floor polishing equipment, mops, brooms and a year’s worth of cleaning supplies. The cost of cleaning out the ruined inventory and replacement could be covered.

Salons and beauty services

A vandal breaks in and slashes salon chairs and smashes porcelain sinks and mirrors. BPP insurance coverage could help to replace and install these business essentials to get you back to work fast.

Business Personal Property insurance FAQ (frequently asked questions)

What is Business Personal Property insurance?

Commercial property insurance coverage has three main parts:

- BPP insurance (business personal property)

- Building coverage

- Business income insurance coverage, also called business interruption insurance

BPP coverage can help cover the contents of your business space, such as equipment, inventory, furniture, flooring and fixtures.

Building coverage could help protect the building structure itself, including things like HVAC systems, sprinklers systems or damage from a fallen tree.

Business income insurance could help cover lost income if a business is forced to close for repairs after an unexpected covered event, such as a fire or vandalism.

Together these coverages are packaged together in a commercial property insurance policy.

Is Business Personal Property insurance (BPP insurance) the same as a Business Owner’s Policy (BOP insurance)?

No. Though the names and acronyms may be similar, business personal property and a Business Owner’s Policy (BOP insurance) are different types of business insurance.

Business personal property insurance (BPP insurance) can help cover the contents of your business space — equipment, inventory, furniture and custom upgrades you made to the space. It’s a part of commercial property insurance.

A Business Owner’s Policy (BOP insurance) is a single policy that combines both commercial property insurance (with BPP coverage) and general liability insurance coverage. The cost for BOP insurance is often less expensive than buying property insurance and general liability policies on their own.

How do I get Business Personal Property insurance with NEXT?

You can buy business personal property coverage as part of NEXT’s commercial property insurance.

Start an instant quote to see options and get an exact cost customized for your business. You can buy your policy 100% online and get your certificate of insurance (COI, or proof of insurance) in about 10 minutes.

If you have questions, our licensed, U.S.-based insurance professionals are available to help.

How do I make a Commercial Property insurance claim?

You can file a claim anytime online or in the NEXT app.

You’ll be asked to share the details of what happened and to provide relevant photos and documentation. We strive to make claims decisions as quickly as possible so that you can get back to work.

When will I get my policy and proof of insurance?

It takes about 10 minutes to get a quote, buy coverage and get access to policy documents and your certificate of insurance (COI).

You can access your documents and COI 24/7 online or in the NEXT app for iPhone or Android.

How much Commercial Property insurance do I need?

The amount of property insurance best for your business depends on many variables, such as:

- Property value

- Location

- What the building is used for

- The number of employees and customers you have

- Your building structure and stability

- Preventive measures like fire-retardant materials, sprinklers and alarms

Knowing the value of your building, inventory and equipment can help you decide on the amount of coverage you require — and not overpay on insurance.

Commercial property insurance policies are based on the actual cash value of your business assets, or what it would cost to replace your property in its current condition. This is different than your business property’s replacement value, which is the cost to replace or repair your property if it’s damaged or destroyed.

NEXT Insurance reviews

Satisfied Customer

Best business insurance with the easiest process!

Stephen H.

Small business insurance

I thought next was easy to use, great rates and outstanding follow-up.

Taylor M.

Small start up

Thanks for helping a small startup. Was able to get the insurance I need for a cost I could afford.

Deborah H.

Easy to use

Great! Set everything up and got the insurance needed for my business without hassle and it was very easy and quick to navigate.

Myles C.

Great!

Hassle free and great to work with. Affordable.

Anthony G.

Peace of mind

easy to apply and and customer service is very responsive

Darrell W.

Easy & affordable

This company makes the process very easy & affordable. Thank you for this service!!

Ronald M.

Easy to sign up and has what I need.

Only took about 10 minutes to have all my questions answered and get the plan I need for my business. Great price and easy to understand plan.

Annick L.

The best service.

Thanks for your help with my needs, I'm very grateful for your assistance and help. I will recommend your company to others

JOEL C.

Blown away

Truly a great team of people that worked really hard to get everything together for me and went out of there way to make it fast and easy

Raaf C.