BOP Insurance: Business Owner's Policy

General Liability plus Commercial Property insurance in one convenient package

Choose your primary industry to get started:

BOP insurance can help protect from both liability and common business accidents

Theft of business gear

You turn your back and someone steals your business laptop from your shop. You’ll need a replacement.**

Property & inventory damage

A pipe bursts and ruins furniture, flooring and all inventory in your stockroom.

Business income interruption

A storm damages your business and bills need paying while you’re closed for repairs.

Medical fees for non-employee injuries

If someone gets hurt in a slip-and-fall and your business is responsible.

Legal fees & defense costs

You’re sued for a covered accident and you need a lawyer — even if you did nothing wrong.

Equipment failure

Your HVAC unit stops working the day after the warranty expires.

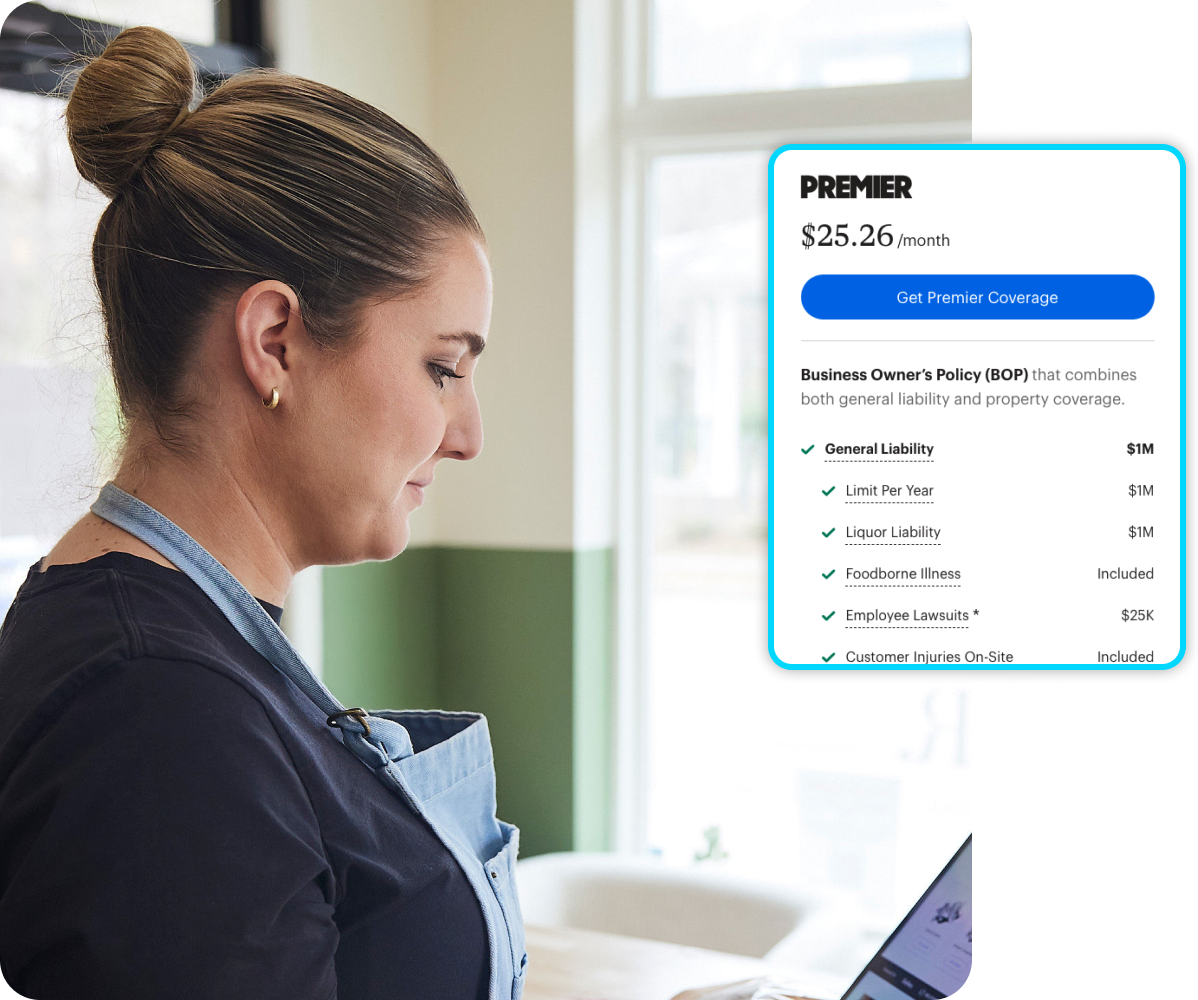

How much is a Business Owner’s Insurance policy?

BOP insurance coverage can cost as little as $25/month† for some low-risk businesses.

Several factors influence the price you’ll pay for insurance, including:

-

- Your industry

- Your business operations

- The size of your business

- Where you do business

- Your business needs and how much coverage you choose

- Policy limits

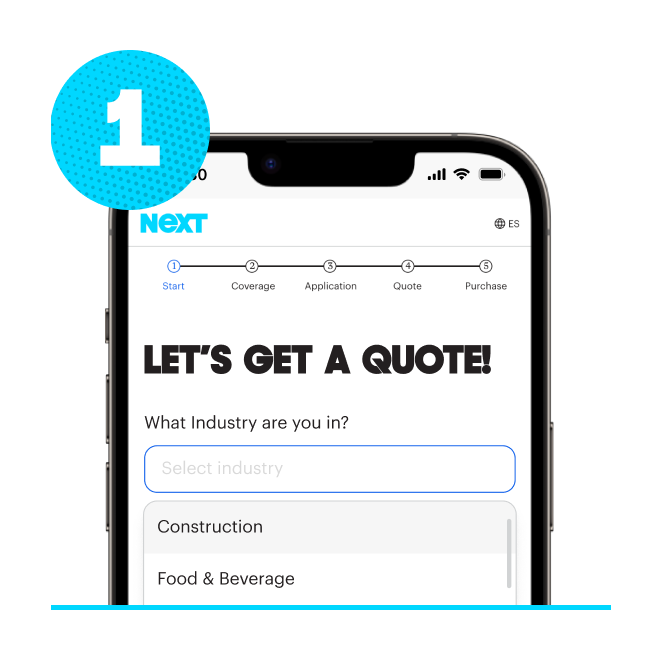

How to get a BOP insurance quote

Start a free online quote

In about 10 minutes you’ll see the exact price you’ll pay for Business Owner’s Policy insurance online.

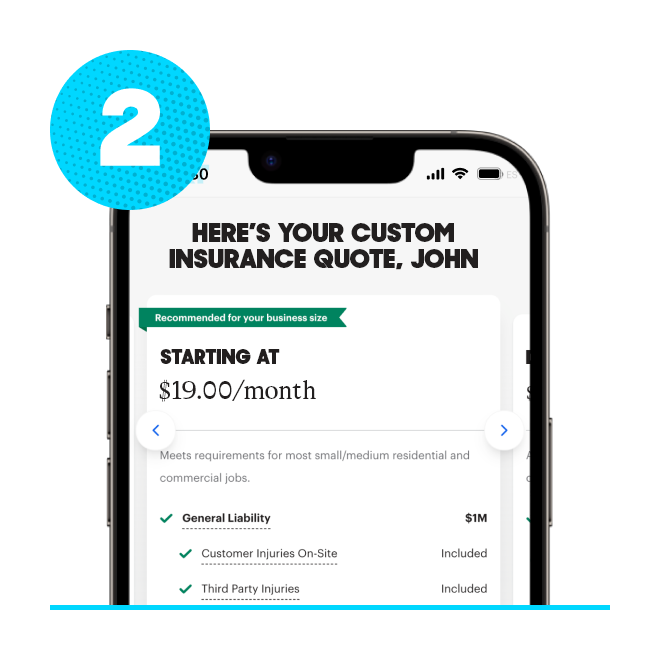

Customize your coverage

Adjust your policy limits and deductibles to pick the right coverage at the right price.

Buy 100% online

Your coverage is effective immediately after payment. And your certificate of insurance is ready at no extra cost.

Who needs Business Owner’s Policy insurance?

Business consultants

Retail and e-commerce

Office and professional services

Sports and fitness

Restaurants and food service

Beauty and personal care

Business Owner’s Policy insurance FAQ (frequently asked questions)

Is BOP insurance legally required?

A Business Owner’s Policy is not usually required by law.

However, commercial landlords may require you to have insurance for a commercial rental property when you sign a lease. Financial lenders could also require you to have coverage to buy business property with a bank loan.

How do I make a BOP insurance claim?

You can file a claim anytime online or in the NEXT app.

You’ll be asked to share the details of what happened and to provide relevant photos and documentation. We strive to make claims decisions as quickly as possible so that you can get back to work.

When will I get my policy and proof of insurance?

It takes about 10 minutes to get a quote, buy coverage and get access to policy documents and your certificate of insurance (COI).

You can access your documents and COI 24/7 online or in the NEXT app for iPhone or Android.

How is a BOP different from Commercial Property insurance?

Commercial property coverage can provide protection over goods, gear, inventory and structures that you own for your business.

A Business Owner's Policy can cover all of this, plus general liability risks such as damage to other people’s property, injuries to customers or vendors and some legal fees.

If you know your business needs both commercial property insurance coverage and general liability, you can typically save money by combining them in a BOP policy.

Compare Business Owner's Policy coverage with commercial property insurance.

Do I need additional General Liability insurance if I have a BOP?

The liability coverage you get through a BOP is usually the same protection you get from a general liability insurance policy.

When you buy Business Owner's Policy insurance instead of general liability coverage, you get the added benefit of commercial property insurance. This extended protection could help cover equipment breakdowns, inventory and the physical building you use for your business.

Can you tailor coverage to a specific industry in a BOP?

A Business Owner’s Policy can be customized to the specific needs of your business. It can easily be combined with relevant coverage and protection for your industry.

For example, if you own a restaurant, a food spoilage endorsement could help if a power outage causes your walk-in freezer to fail and ruin your inventory.

Does BOP insurance cover theft?

Your BOP coverage can include protection against theft of your business property at your business location.

If you’re in construction or cleaning and you often carry gear between job sites, tool and equipment insurance could help if someone steals your tools (which is not standard in BOP policies).

Can I add an additional insured to my Business Owner’s Policy?

Yes. NEXT customers can easily add an additional insured and share their certificate of insurance at no extra cost through their customer account.