What is Business Income insurance?

What can Business Income insurance cover?

- Lost income after some catastrophic events

- Payroll and continued operating expenses

- Extra expense coverage for temporary costs

- Service or supply disruption expenses

How much does Business Interruption insurance cost?

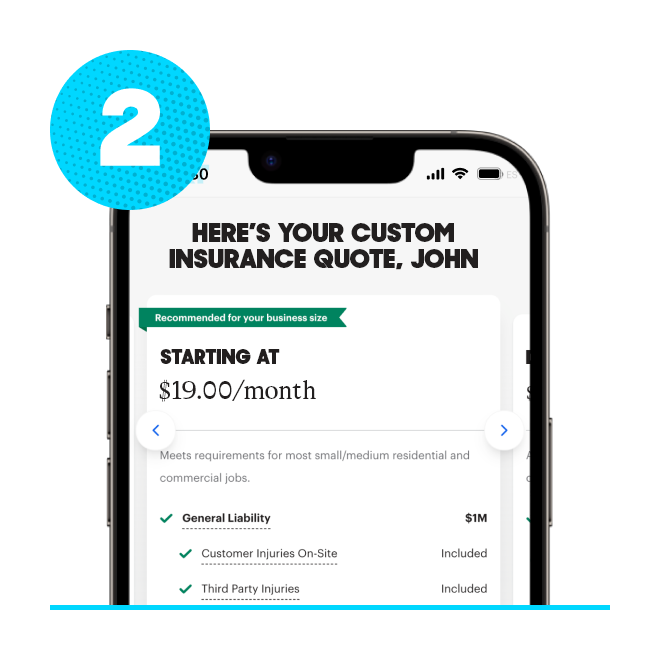

Starting at $19/month†

Buy online in about 10 minutes, and cancel anytime.

Who needs Business Income coverage most?

- Any business with a physical location

- Businesses with regular operating costs

- Business owners with payroll expenses

- Businesses that rely on regular sales

Business continuity insurance can help shield your business from these types of business risks

Lost revenue

A kitchen fire damages your business and you’re closed for a week of repairs. Income insurance can help keep you whole.**

Temporary relocation expenses

A burst pipe damages your office and you need to relocate during repairs. Your business disruption insurance could help with additional rent.

Short-term payroll gaps

A big storm destroys your shop and you close for cleaning and construction. Get help paying wages until it’s safe to reopen.

How much does Business Income insurance with Commercial Property coverage cost?

Business income insurance is a part of NEXT’s commercial property insurance coverage. It can cost as little as $18/month† for some low-risk businesses.

Several factors influence the price you’ll pay for insurance, including:

- Your industry

- Your business operations

- The size of your business

- Where you do business

- Your business needs and how much coverage you choose

- Policy limits

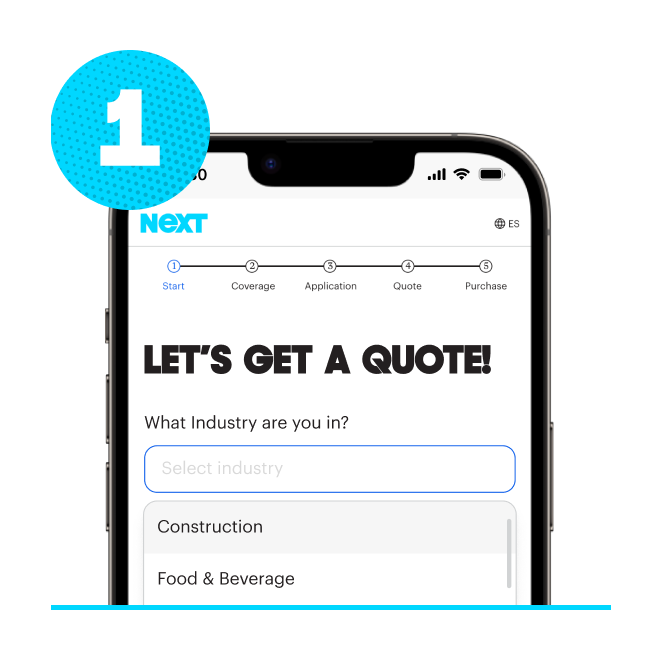

How to get Commercial Property insurance with Business Interruption coverage online

Start a free online quote

In about 10 minutes you’ll see the exact price you’ll pay for a business interruption policy online.

Customize your coverage

Adjust your policy limits and deductibles to pick the right coverage at the right price.

Buy 100% online

Your coverage is effective after payment. And your certificate of insurance can be shared at no extra cost.

Who needs Business Income insurance coverage?

Restaurants and food services

Cafés, food trucks and restaurants rely on daily sales. If a kitchen fire or power outage force you to close, coverage could help replace lost income and payroll costs during repairs.

Retail and e-commerce

Retailers and online shops can lose sales when physical storefronts or inventory are damaged. Business income coverage could help with expenses while you recover.

Construction trades and contractors

Contractors, builders and tradespeople can face lost income if job sites close after fire, theft or storm damage. Coverage could help with operating expenses during downtime.

Beauty and personal care

Salons, barbers and spas depend on steady appointments. If plumbing problems or theft halts service, coverage can help replace some business costs.

Business Income insurance FAQ (frequently asked questions)

Are Business Interruption insurance and Commercial Property insurance the same thing?

Commercial property insurance coverage has three main parts:

- Business personal property insurance (BPP insurance)

- Building coverage

- Business income insurance coverage, also called business interruption insurance (BII)

BPP coverage can help cover the contents of your business space, such as equipment, inventory, furniture, flooring and fixtures.

Building coverage could help protect the building structure itself, including things like HVAC systems, sprinklers systems or damage from a fallen tree.

Business income insurance could help cover lost income if a business is forced to close for repairs after an unexpected covered event, such as a fire or vandalism.

Together these coverages are packaged together in a commercial property insurance policy.

How do I get business continuity insurance with NEXT?

You can buy business interruption coverage as part of NEXT’s commercial property insurance.

Start an instant quote to see options and get an exact cost customized for your business. You can buy your policy 100% online and get your certificate of insurance (COI, or proof of insurance) in about 10 minutes.

If you have questions, our licensed, U.S.-based insurance professionals are available to help.

How do I make a Business Income coverage claim on my Commercial Property insurance?

You can file a claim anytime online or in the NEXT app.

You’ll be asked to share the details of what happened and to provide relevant photos and documentation. We strive to make claims decisions as quickly as possible so that you can get back to work.

When will I get my policy and proof of insurance?

It takes about 10 minutes to get a quote, buy coverage and get access to policy documents and your certificate of insurance (COI).

You can access your documents and COI 24/7 online or in the NEXT app for iPhone or Android.

How much BI Insurance/Commercial Property insurance do I need?

The amount of property insurance best for your business depends on many variables, such as:

- Property value

- Location

- What the building is used for

- The number of employees and customers you have

- Your building structure and stability

- Preventive measures like fire-retardant materials, sprinklers and alarms

Knowing the value of your building, inventory and equipment can help you decide on the amount of coverage you require — and not overpay on insurance.

Commercial property insurance policies are based on the actual cash value of your business assets, or what it would cost to replace your property in its current condition. This is different than your business property’s replacement value, which is the cost to replace or repair your property if it’s damaged or destroyed.

What’s not covered by business disruption insurance?

Commercial property insurance that includes business income protection won’t cover every type of financial loss. Coverage typically applies after a covered cause of direct physical loss.

Business property coverage won’t usually pay for:

- Voluntary shutdowns for damaged property or utility service failures

- Losses from floods or earthquakes

- Extensive damage that falls outside your commercial property insurance policy

- Pandemic or supply chain shutdowns

Business income coverage, a part of commercial property insurance, is often paired with general liability insurance in a Business Owner’s Policy (BOP insurance) for broader protection.

Can I buy loss of income coverage by itself?

No. Business income coverage is typically included as part of a commercial property insurance policy. It’s not usually sold as standalone coverage.

NEXT Insurance reviews

Satisfied Customer

Best business insurance with the easiest process!

Stephen H.

Small business insurance

I thought next was easy to use, great rates and outstanding follow-up.

Taylor M.

Small start up

Thanks for helping a small startup. Was able to get the insurance I need for a cost I could afford.

Deborah H.

Easy to use

Great! Set everything up and got the insurance needed for my business without hassle and it was very easy and quick to navigate.

Myles C.

Great!

Hassle free and great to work with. Affordable.

Anthony G.

Peace of mind

easy to apply and and customer service is very responsive

Darrell W.

Easy & affordable

This company makes the process very easy & affordable. Thank you for this service!!

Ronald M.

Easy to sign up and has what I need.

Only took about 10 minutes to have all my questions answered and get the plan I need for my business. Great price and easy to understand plan.

Annick L.

The best service.

Thanks for your help with my needs, I'm very grateful for your assistance and help. I will recommend your company to others

JOEL C.

Blown away

Truly a great team of people that worked really hard to get everything together for me and went out of there way to make it fast and easy

Raaf C.