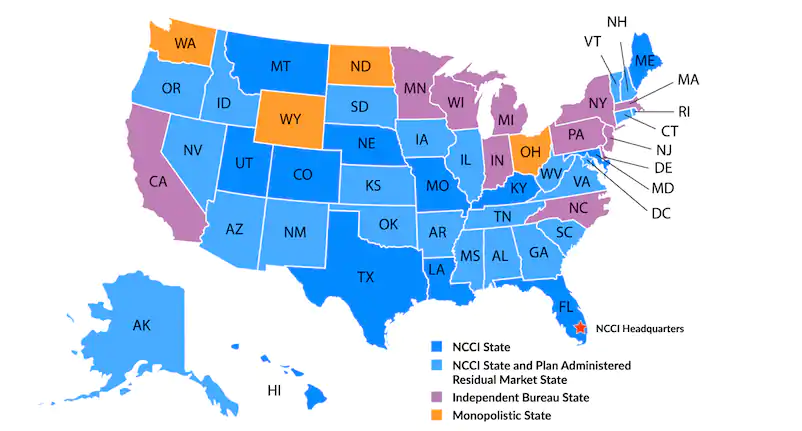

Independent state codes are just what they sound like — the state has its own independent rating bureau. Employers in the following states can expect slightly different rules and compensation codes than those found in NCCI states:

In monopolistic states, employers must purchase coverage from a government insurance fund:

How class codes affect small businesses

Class codes affect the workers’ compensation rates you pay. This is why businesses with more than one type of employee often use multiple codes.

For example, a small construction company may use separate codes for their employees:

- Project managers (NCCI code 5606)

- General construction workers (NCCI code 8227)

- Clerical office employees (NCCI code 8810).

Employees performing tasks with different associated risks are classified differently on your workers’ compensation policy. Because a clerical employee likely has less risk associated with their job than a general construction employee, you would pay less for their coverage.

Occasionally, you may see the abbreviation NOC or “not otherwise classified” on your workers’ comp policy. It means that the insurance underwriter or auditor could not place your business in a more specific classification code so they assign it a more general code.

An accurate count of employees and clearly defining their duties with your insurance company is crucial. It ensures you’re assigned the correct workers’ comp class codes for your workers. This helps you avoid overpaying for insurance you don’t need and protects your business from potential discrepancies during a workers’ compensation audit.

Workers’ compensation classification errors and misuse

Let’s say you misclassify a construction worker (higher-risk job) as a clerical worker (lower-risk job) to try and spend less on workers’ comp coverage.

If an incorrect NCCI classification with a lower cost is assigned to your workers, auditors will likely catch the mistake (state regulators require annual audits in most states).

If the cost has been underestimated, you will pay the difference. If auditors find willful misclassification, you might be responsible for fines or other penalties, depending on your state.

Another possible consequence of miscoding is that your insurer could refuse to pay for injuries sustained during work duties that are clearly outside the scope of the classification for that employee. This will leave you liable for the full costs.

Workers’ compensation class codes help determine your risk and correctly price your workers’ compensation insurance. By not having to assess the risk of every job, the NCCI and state rating bureaus ensure insurance providers are acting fairly and giving you the coverage you need.