Is a Utah handyman license required?

If you plan to perform mostly minor repairs and basic maintenance as a handyman, it’s unlikely that you need a license.

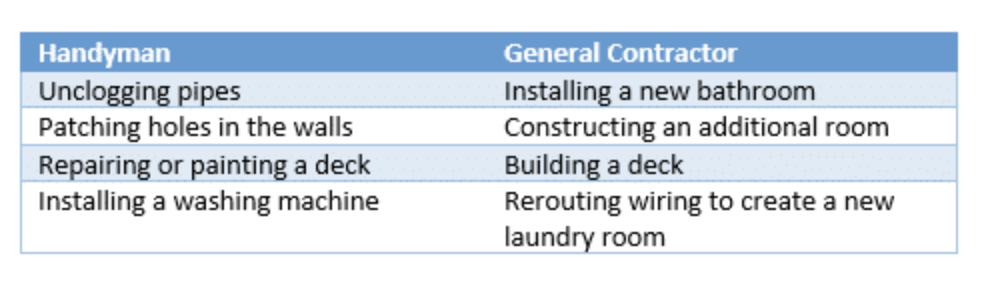

You only need a license in Utah if you plan to perform certain types of jobs that go beyond the scope of minor repairs. If your work will become a finished part of the structure (such as replacing flooring in an entire room) and the total for the project exceeds $3,000, you must have a Utah general contractor license.

How to get a handyman license in Utah

Contracting work in Utah generally requires a state license issued by the Utah Division of Occupational and Professional Licensing (DOPL).

However, Utah sets its licensing requirements for handypeople based on the value of the projects they work on. You do not need a contractor license if your projects have a value of less than $3,000, including labor and materials. Instead, you must simply register with the DOPL if you plan to take on any projects valued at more than $1,000.

Generally known as the handyman exemption, this rule applies to workers who engage in “the alteration, repair, remodeling or addition to or improvement of a building.” Note that it does not apply to workers who conduct plumbing, electrical or HVAC work, all of which do require a license.

If the value of your work projects exceeds the $3,000 limit, you must have a Utah contractor license. The state takes this seriously, and the DOPL has conducted sting operations to fine businesses which attempt to take on jobs over $3,000 without the proper license.

If you fall under the handyman exemption, you will not need to complete and submit a license application. However, you do need to register by submitting an Affirmation of Exemption from Contractor License.

This form functions as an affidavit that certifies your qualifications for the exemption. You must submit a non-refundable $35 processing fee along with the form.

The state classifies those whose work exceeds $3,000 on single projects as a contractor rather than a handyperson. If this applies to you, check out our guide to Utah general contractor license and insurance requirements, including instructions on submitting your license application

The Utah handyman license exemption form

If you submit your handyperson exemption form, you must also include the following documentation:

Business registration

You must register your business with the Utah Division of Corporations and include your business registration number on your handyman exemption form.

General liability insurance

You must submit a certificate of general liability insurance.

Workers’ compensation insurance

If you have employees or plan to hire any within the foreseeable future, you must obtain the following:

- Certificate of workers’ compensation insurance

- Employer identification number from the IRS

- State withholding tax registration number from the Utah State Tax Commission

- Unemployment registration account number from the Utah Department of Workforce Services

If you do not have employees and do not plan to hire any, these requirements do not apply.