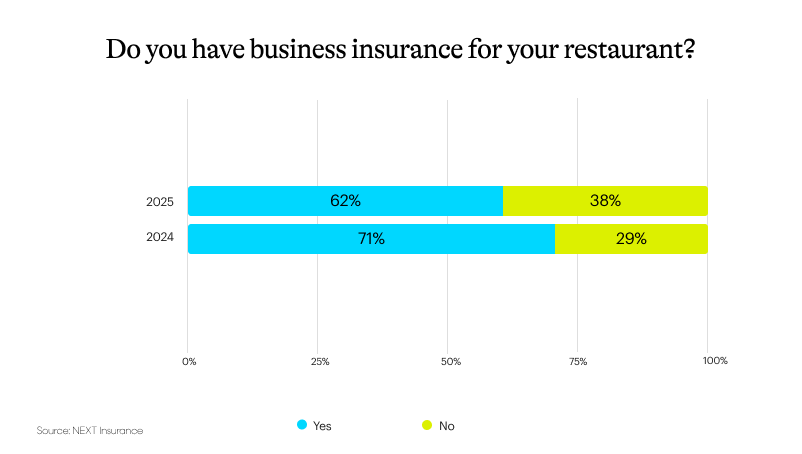

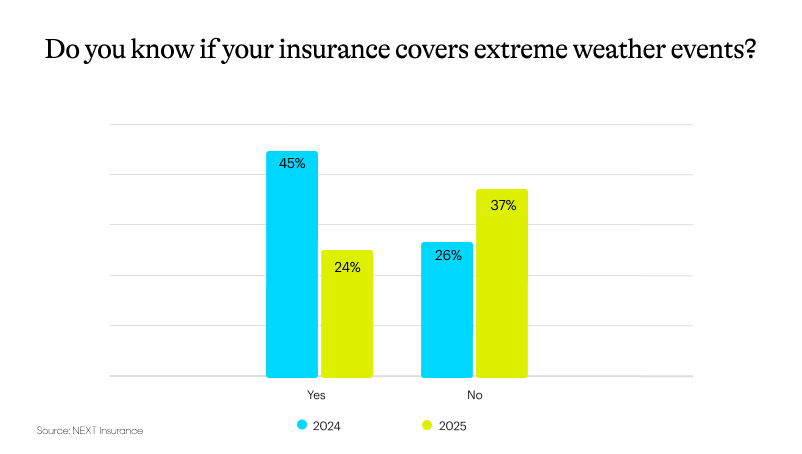

Fewer U.S. restaurant owners nationwide have business insurance than they did a year ago, according to a recent NEXT Insurance survey. And more restaurant owners don’t know if their insurance coverage will cover extreme winter weather, such as storms, snow, hail or ice.

These are just a few of the findings uncovered in the January 2025 survey of 1,500 restaurant owners across the country.

Jump ahead to read the key findings:

- Fewer restaurant owners have business insurance compared to last year

- More food businesses are uncertain about their extreme weather coverage

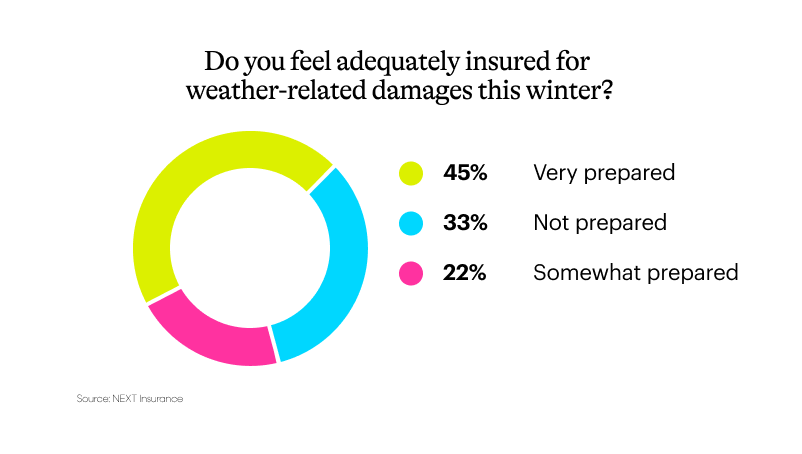

- Over half of restaurant owners question their preparation for winter weather

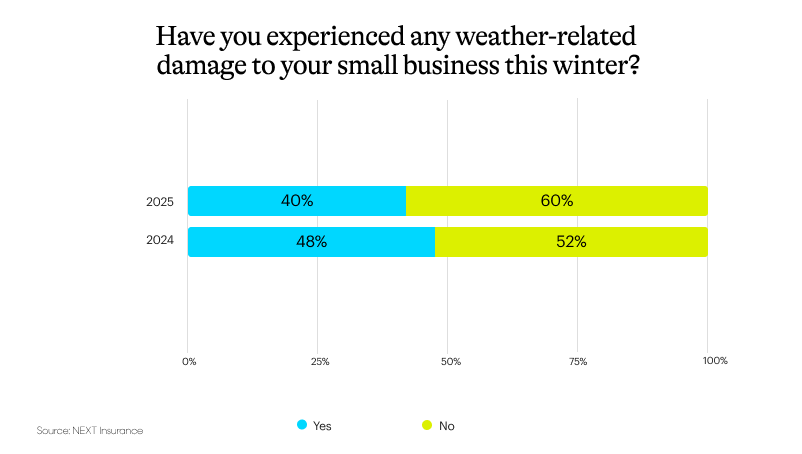

- So far, winter weather-related property damage is down

- How business insurance can shield your restaurant from winter damage

- How NEXT serves insurance protection for restaurant owners