Almost 75% of retail small business owners are impacted by supply chain issues just as the holiday shopping season is reaching its peak, according to a NEXT Insurance survey.

Over the past few months, global supply chain issues have thrown another curve at already stretched small businesses, forcing them to adapt yet again.

This time, owners are contending with limited inventories, higher costs for goods, worker shortages and delivery delays resulting in reduced revenue — all while still competing with cash-rich larger retailers.

In late November, we surveyed small business owners across all sectors, asking how recent supply chain disruptions have impacted them. The 500 business owners surveyed reveal the strain small business retailers are experiencing in what was supposed to be a year of recovery.

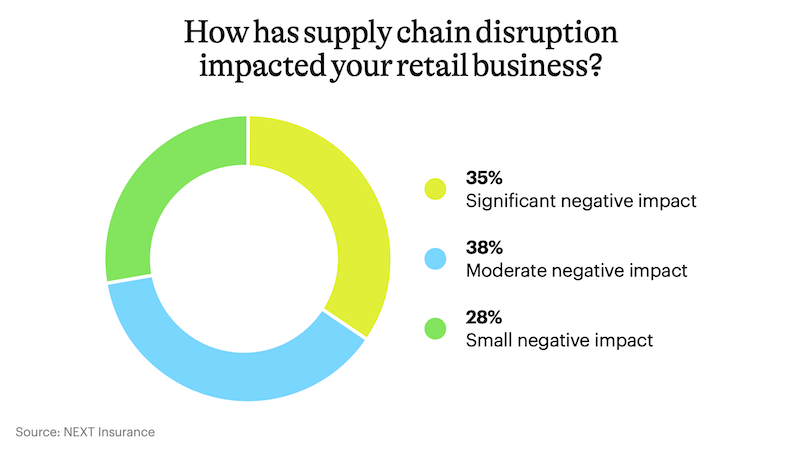

Nearly three-quarters of small business retailers have been negatively affected by supply chain disruptions

Retailers began experiencing disruptions early in the pandemic due to shutdowns, and they’ve never fully recovered.

A variety of global influences, including labor shortages and mobility restrictions, are making it difficult for retailers of all sizes to bounce back this year.

Although most retailers have felt the effects of the disruption, small businesses retailers have been disproportionately affected and are finding it difficult to rebound.

- 73% of small business retailers are experiencing at least moderate negative impacts to their business caused by supply chain issues.

- More than a third of these retailers (35%) report significant negative impacts.

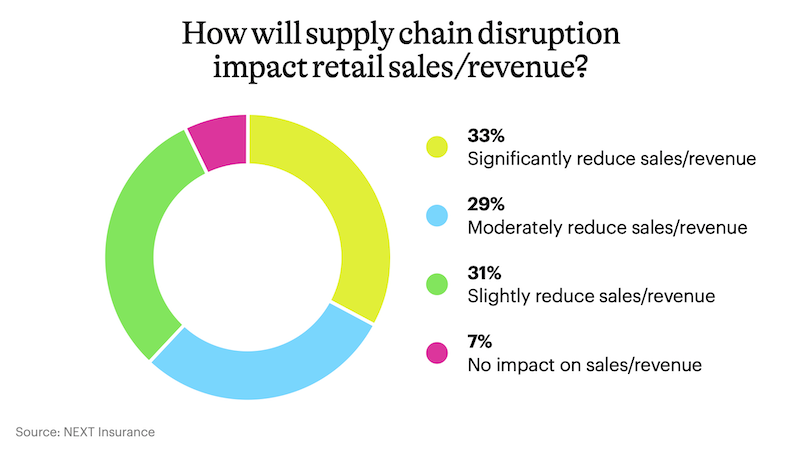

Retailers expect supply chain issues to reduce sales and revenue

Many small retailers already struggle to compete against big-box companies that could offer free shipping and deep discounts. Now, they not only compete for sales but products, too.

With the cost of shipping and raw materials skyrocketing, expenses are being passed on to retailers. Major retailers with deeper pockets have the budgets to stepside delays through private charters and absorb the higher costs for supplies.

Smaller retailers face tougher choices, including cutting into revenue margins or passing the expense on to customers with higher prices.

And even if they’re willing to pay more for goods and shipping, small businesses are often deprioritized due to their purchase volume, falling last in the pecking order. It’s tougher to get the smaller quantities they need and also the specific brands and products they want to sell.

- 62% of small business retailers expect a moderate to a significant reduction in sales/revenue.

- A third (33%) of respondents expect a significant reduction in sales/revenue.

- Only 7% of retailers don’t expect any impact on sales/revenue.

With inflation climbing to a record 30-year high, consumers may be less willing to open their wallets as often, contributing to reduced sales.

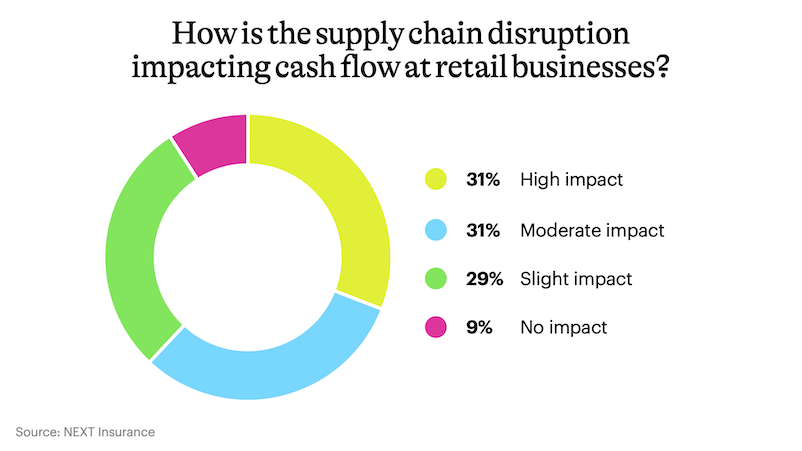

Small retailers say the disruption is impacting their cash flow

With higher supplier costs and reduced sales and revenue, managing cash flow has become more difficult for small businesses.

- 62% of retail businesses say disruptions have a moderate or high impact on cash flow.

- 9% of retailers report the disruption having no impact on cash flow.

Retail businesses have taken several steps to address the disruption and manage cash flows. 57% of retailers report selling fewer products due to delays or unavailability. Nearly half (47%) have paid more for supplies, and 40% have planned by stockpiling supplies when available.

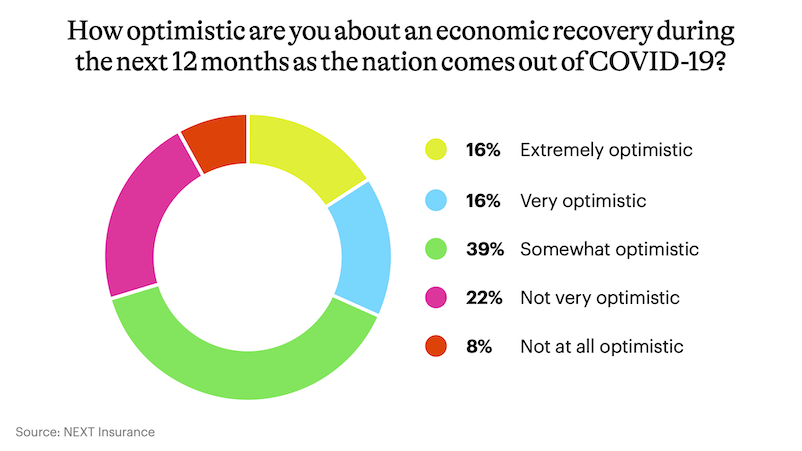

Uncertain economic recovery curtails retailer optimism

2021 began with a lot of promise and a sense of relief as people were looking forward to easing restrictions and economic recovery. This summer, business owners shared optimistic sentiments that things were on the right track.

But, the lasting effects of economies coming to a standstill are catching up, causing ongoing frustration with small business retailers.

Aside from supply chain issues, they’re also contending with worker shortages, increased employee wages and increased reports of organized retail crime.

- 39% of retailers are somewhat optimistic about an economic recovery in the next 12 months.

- 32% of retailer owners are extremely optimistic or very optimistic about recovery in the next 12 months.

Despite forecasts of record holiday sales — a rise between 8.5% and 10.5% — it’s clear that small retailers are more cautiously optimistic this survey round.

Gen Z, millennials and males report experiencing supply chain disruptions

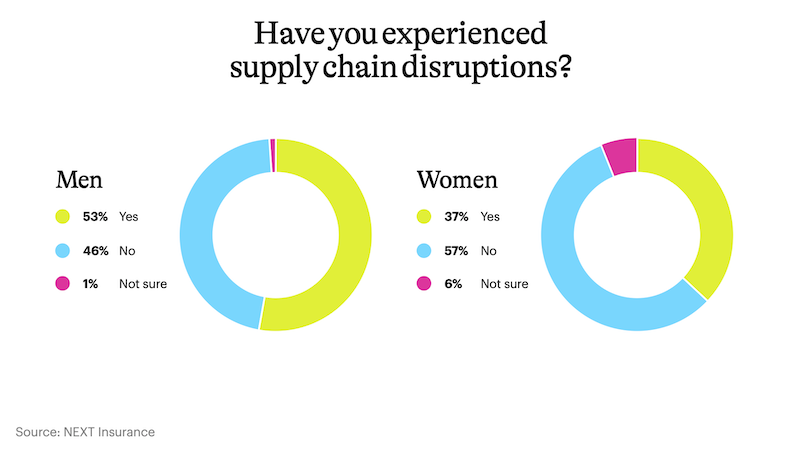

Looking broadly outside of retail, our survey data reveals that more men (53%) mentioned they were experiencing supply chain disruption than women (37%).

- 53% of male small business owners have experienced supply chain issues vs. 37% of female owners.

- 57% of female owners report not being impacted by supply chain disruption

This is likely attributed to the industries most affected by the disruption. According to U.S. Census data, some of the hardest-hit industries include manufacturing, construction and retail trade. Both manufacturing and construction industries employ fewer women overall — women make up 30% of total employed for manufacturing and 11% of the total for construction — thus adversely affecting men more.

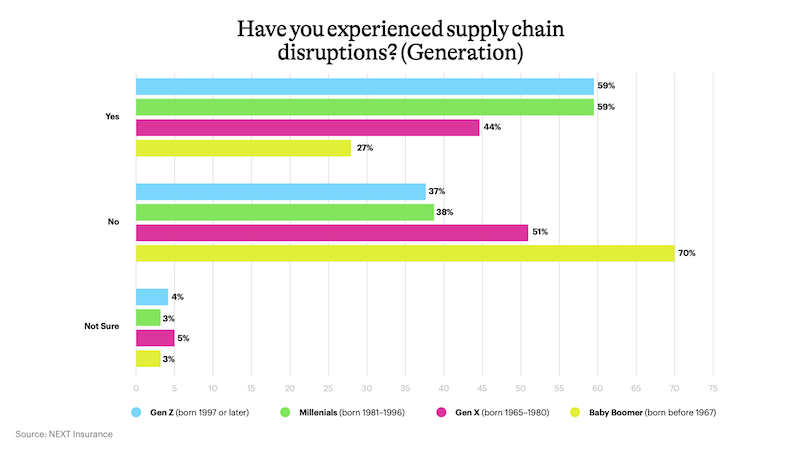

- 59% of Gen Z and 59% of millennials have experienced supply chain issues.

- 70% of baby boomers have not experienced disruption.

The data also reveals that Gen Z (59%) and millennial (59%) business owners experienced more supply chain disruptions than baby boomers (27%).

Could this gap come down to buying power? Our data shows that half (50%) of Gen Z owners traveled further to get supplies, while baby boomers (14%) were not inclined to do so.

Millennials (56%), Gen X (44%) and baby boomers (46%) primarily chose to pay more for supplies, with baby boomers showing the strongest inclination to stockpile supplies when available (38%).

How NEXT Insurance helps small businesses thrive

NEXT specializes in custom business insurance packages for retail businesses.

Our easy online tools allow you to get a quote, buy coverage and secure a certificate of insurance in less than 10 minutes. If you need help at any point along the way, our licensed U.S.-based insurance advisors are ready to help.