How to file small business taxes as a beginner

The goal for your small business taxes is more than calculating what you owe. It’s also to avoid overpaying.

Many small business owners strategically save for taxes throughout the year. Understanding your tax obligations gives you a better estimate for when you file and pay your taxes. But you can use deductions to minimize your tax liability and keep more money in your business.

How to categorize receipts for taxes for small business

Keeping track of financial records is your foundation for how to categorize receipts for taxes for small businesses. No matter what system you use — paper ledger, bookkeeping software, or professional accountant — having a system helps you:

- Monitor income and expenses accurately

- Identify tax deductions confidently

- Prepare tax returns more quickly

- Support your deductions if needed

It’s best to keep your personal and business accounts separate. Separate accounts make it easier to log your business expenses and protect your personal finances.

When categorizing transactions, include your business insurance payments in your financial records — the premiums are typically tax-deductible. For example, if a customer trips in your store, general liability insurance protects your business. Running business errands? Commercial auto insurance has you covered. Both types of premiums can qualify as business expenses.

Consider how business structure affects filing small business taxes

You decide on a legal business structure when you form a business. Each type of business entity has its own tax rules and implications:

- Sole proprietorship: You and your business are one entity for tax purposes. Business income and expenses go on your personal tax return.

- Partnerships: Business profits “pass-through” to the partners. Each partner reports their share of business income on their personal tax return.

- Corporations: Your business pays taxes separately from your personal return.

- S-corps: Combines corporation benefits with pass-through taxation. Business profits flow to your personal tax return, potentially reducing self-employment taxes.

- Limited liability company (LLC): Tax treatment depends on ownership. Single-owner LLCs typically file like sole proprietors, while multi-owner LLCs usually file like partnerships.

Be sure to file all business tax forms

Every small business must pay taxes, but not all small business taxes are the same. How much small business taxes comes down to these five types the IRS says you may have to pay:

- Income tax: This covers your business earnings. How you file depends on your business structure.

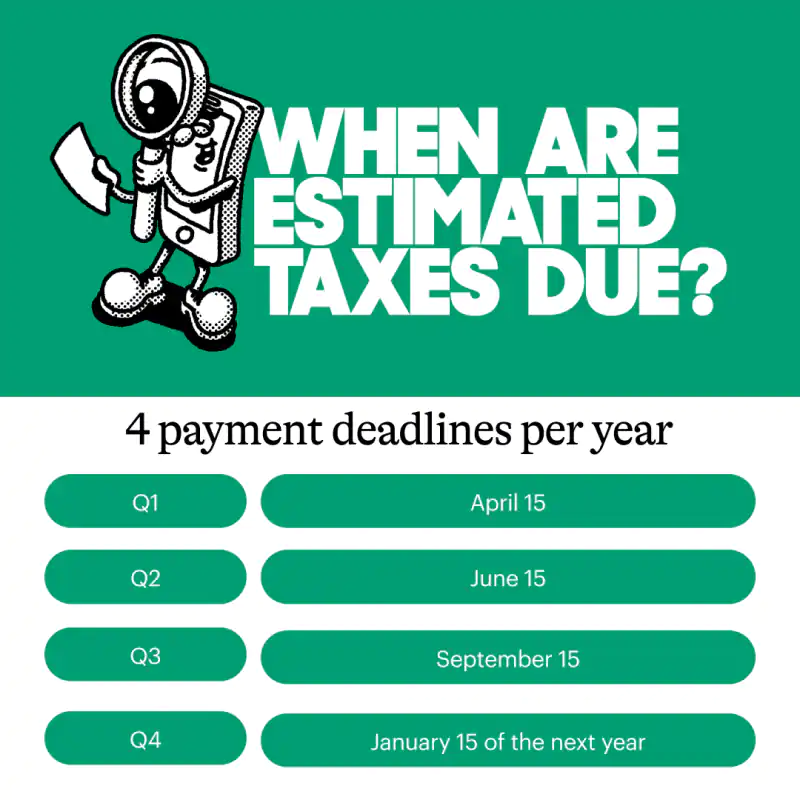

- Estimated tax: A combination of income and self-employment tax that you pay throughout the year, rather than all at once.

- Self-employment tax: This covers your Social Security and Medicare contributions, which you’re responsible for since no employer is withholding these for you.

- Employment tax: Additional taxes can apply if you have employees, so knowing how to calculate payroll taxes for small businesses can help.

- Excise tax: Some specific industries pay additional taxes on certain products or services, like fuel taxes for transportation companies.

Note that if you’re paying employment tax because you have employees, you’ll likely need workers’ compensation insurance. It’s required by law in most states. Keep good records of your premium payments, as they’re typically tax-deductible.

How much does a small business pay in taxes?

To know how much small business taxes are, let’s break down your business tax bill into simple math.

It starts by calculating your gross taxable income. You’ll take your total income and subtract your deductions and tax credits to find your gross taxable income. Here’s what that looks like:

Total Income – Deductions – Tax credits = Gross Taxable Income

Once you have your gross taxable income, you’ll need to factor in your business structure and tax bracket to get your final tax bill.

Check the tax calculator for small businesses

How much can a small business make before paying taxes? It depends on your business structure, available deductions, and filing status — there’s no single formula or tax rate to calculate a threshold.

The IRS recommends Form 1040-ES to calculate estimated taxes if you’re self-employed or run a small business. There’s an alternative form for non-resident aliens to use called Form 1040-ES(NR).

Find your tax rate if you’re a sole proprietor, partnership, LLC, or S-corp

If you run a sole proprietor, partnership, LLC, or S-corp, your business income “passes through” to your personal tax return. This is what the IRS classifies as a pass-through entity. It means your profits combine with your personal income, and you’ll pay taxes based on personal tax brackets.

Tax rates and standard deductions for single filers and joint tax returns can change yearly, so check with the IRS or your accountant for current guidelines.

If you’re a C-corp, find your tax rate

The Tax Cuts and Jobs Act simplified C-corporation taxes with a flat 21%. So, regardless of your income level, your C-corp pays 21% of its income in taxes.

But C-corp owners often encounter what’s called “double taxation.” This is because your business pays taxes on its income, and you’ll also pay personal taxes on any dividends you receive from the C-corp.

Still, C-corps can offer more flexibility for growing businesses. If you’re interested in restructuring your LLC as a C-corp, read our guide on how to incorporate a business.

Estimate 1099 independent contractor or freelancer taxes

The IRS often classifies 1099 contractors and freelancers as sole proprietors. Unless you’ve formally established a business entity, it’s the default business structure.

Filing 1099 taxes as a beginner requires careful planning, such as logging income, setting aside money for quarterly payments, and organizing business expenses.

Tip: Even as an independent contractor, you face real business risks and should consider freelance business insurance.

For example, if you’re a freelance web designer and a client claims your code caused their website to crash during a major sale, professional liability insurance could protect you. Or if you meet clients at your home office and someone trips, a Business Owner’s Policy (BOP) could cover their medical expenses. These insurance premiums typically count as tax-deductible business expenses.

Quarterly small business tax payments vs. annual

Think you can choose between annual and quarterly tax payments? Not always. The IRS can require quarterly estimated tax payments if you meet specific criteria. Generally, you’ll need to fork over cash to Uncle Sam quarterly if both of the following apply:

- You expect to owe $1,000 or more in tax after subtracting withholding and refundable credits.

- Your withholding and refundable credits will be less than 90% of your expected 2024 tax, or 100% of your 2023 tax (based on a full 12-month return).

Here’s why timing matters: Without an employer withholding taxes from each paycheck, you’re responsible for knowing how much to set aside for taxes yourself. This can be challenging, especially when you need to account for both income tax and self-employment tax.

Many new business owners are surprised by their first tax bill because they didn’t factor in these additional costs.

You generate an estimate using Form 1040-ES and pay the IRS as you go. It helps to look at your past earnings to project future income, and consider any seasonal patterns in your business. Remember to adjust your estimates if your income changes significantly during the year.