When COVID-19 led to a global economic shutdown earlier this year, small businesses were some of the hardest hit in the U.S. economy.

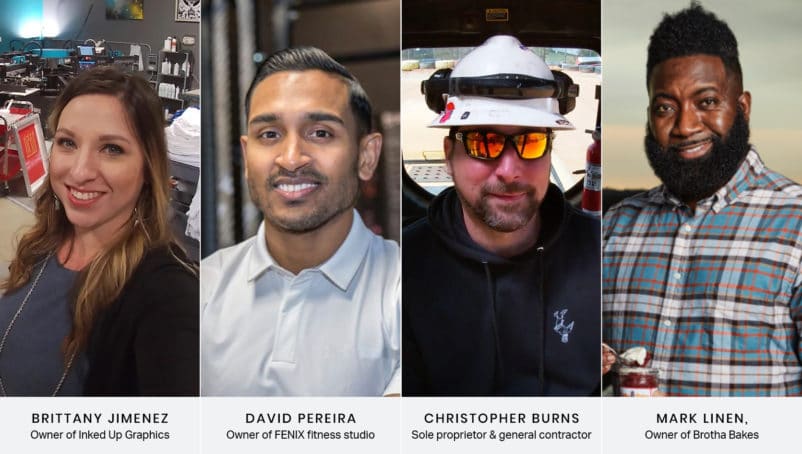

In an effort to learn more and share details about how businesses were able to succeed despite the numerous challenges, we organized a Small Business Roundtable. These four business owners from different industries across the country shared their unique experiences and provided valuable advice and perspectives:

- Mark Linen, owner of Brotha Bakes in Houston

- Brittany Jimenez, who owns and operates Inked Up Graphics in northern California.

- David Pereira, a personal trainer and owner of FENIX fitness studio in New Jersey

- Christopher Burns, a sole proprietor and general contractor in the Philadelphia area

https://www.youtube.com/watch?v=bUV0A74wxgw

“[The impact] was quicker than you could ever think,” says Christopher Burns, a sole proprietor and general contractor in Levittown, Pennsylvania, and one of four panelists in Next Insurance’s first-ever Small Business Roundtable. His work stopped immediately in March, and it was two months before he had any customers again. “I don’t think I’ll be 100% operational again until the middle of next year.”

Burns isn’t alone. Like our other roundtable panelists and many Next Insurance customers, he had to get creative, seek out new resources for income and find ways to cut expenses to get through the pandemic-inspired recession.

Here are three takeaways from how our panelists kept their doors at least partially open and adapted to the new normal of conducting business in the U.S:

1. Take advantage of all available resources

“The hardest part for us was sending our employees home,” says Brittany Jimenez, who owns and operates Inked Up Graphics with her husband in Redding, California.

Eager to get their employees back to work, they applied for a Paycheck Protection Program loan through the SBA.

When funds came through, Jimenez says Inked Up was more than ready to have help in the office again. After the initial shock of losing some big accounts due to event cancellations, Jimenez says business started to return to normal levels about five weeks after the initial shutdown in California.

“In terms of volume, we’re operating at full capacity now,” she says.

David Pereira, a personal trainer and owner of FENIX, a fitness studio in Englewood, New Jersey, also received a PPP loan. All of his personal trainers are independent contractors, so Pereira said he really benefited from being part of a community of independent businesspeople who shared information about available resources and how to apply for them.

Jimenez agrees that a sense of community was critically important for her and her husband.

“We’re a small business reliant on other small businesses,” she says. That’s one reason Inked Up launched a T-shirt fundraiser to support 14 of their local business customers through the crisis.

Jimenez says she also contacted her company’s vendors to request extensions on payments they owed.

2. Adjust business models

When the coronavirus arrived in the United States, Mark Linen, owner of Brotha Bakes in Houston, had only recently started his cake baking business and had plans of gradually taking his new and largely online company to the public. That all changed with COVID-19.

Linen felt like he had a “COVID-friendly” product, so “we ramped things up online,” he says.

"When you have a product that's sealed in a jar, it works out,” says Linen, about his unique approach to baking cakes in a jar. "[COVID] has actually been good for my business."

Orders across the country have skyrocketed, so much so that he’s working harder than ever to keep up with demand.

Social distancing creates an opportunity for for ‘social fitnessing’

Pereira also had to adjust his business model to accommodate online workout rather than in-person engagement. A new business owner, Pereira’s gym was only open for three weeks when COVID-19 shut him down.

While he had prepared financially for any potential setback, he knew it was going to be tough to maintain a client base since personal training relies heavily on one-on-one contact with clients.

“The first step was to engage our clients and keep them motivated,” Pereira says. He decided to open his studio to what he calls “social fitnessing” — providing a space for area trainers and instructors to craft online fitness videos.

“This allowed people all over the country to take advantage of virtual workouts,” he says. Pereira also sold FENIX-branded workout kits with fitness equipment during the shutdown, seizing an opportunity when home-gym equipment was hard to find online.

He gave the proceeds from the workout kits to a local hospital and first responders.

3. Putting safety first

“We had to change the narrative of going back to the gym,” Pereira says of finally being allowed to reopen in early July.

As with all four small business owner panelists, Pereira had to make safety a top priority. When clients come off the elevators into his studio, they have to have their temperatures taken. Then it’s straight to hand washing and putting masks on before hitting the gym floor. Pereira’s trainers also clean and sanitize equipment after each workout session.

Before the crisis, FENIX had nine personal trainers and a physical therapist, but for now Pereira is only allowing three in the studio at a time.

“We used to do 150 to 200 sessions a week,” he says. “Now we’re operating at a third of capacity.”

Building a culture of safety

Burns has also introduced new procedures on the job for his construction contracting business. When he and his subcontractors are working in a customer’s house, there can be no more than four people in the residence at a time, and everyone has to wear masks and sanitize.

“We have exhaust fans turned on in every room where someone is working,” he says. “We don’t want to get sick, and we don’t want to get anybody else sick. We’re taking precautions to keep us working and keep everybody safe at the same time.”

Across the board, small business owners feel they can’t be as hands-on with their customers as in the past.

Jimenez says that she and her husband now set appointments for customers at their graphic design business instead of just letting them walk into the shop. But she sees the silver lining: “It’s actually helping our process, as it makes our workflow way easier.”

Ultimately, adaptability is the key to surviving any business crisis. Pereira has certainly expanded his fitness offerings in ways he never expected as a result of COVID-19.

“You can scale so much more with the online presence,” he says. But his biggest piece of advice for weathering the current storm?

“Engage with customers in a different way,” he says. “Can you go deeper? Can you provide other resources?”

Watch the Small Business Roundtable online and learn more about how Next Insurance is helping small business respond to COVID-19: https://www.nextinsurance.com/builtbybusiness/.

How Next Insurance helps small businesses

We’re 100% dedicated to helping small business owners and the self-employed find the business insurance they need without paying for coverage they don’t need or unnecessary fees.

We provide customized insurance packages for more than 1,000 different types of businesses. Coverage typically includes general liability insurance to protect against expenses related to the most common accidents a business might face.

Depending on your operations, we might also recommend professional liability insurance, workers’ compensation and commercial auto insurance.

Start a free instant quote today to explore options for your business. Our licensed, U.S.-based insurance advisors are standing by to help if you need any additional information.