Restaurant owners are having a record-breaking year. With sales expected to exceed $1.1 trillion in 2024, the industry is experiencing its best year yet, according to the National Restaurant Association, despite rising economic pressures.

But if you own a small restaurant, this optimistic outlook may feel like it’s in stark contrast to your day-to-day reality. Succeeding in the restaurant industry has never been easy, and that’s especially true now with inflation, rising payroll costs and a tight labor market.

At NEXT Insurance, we understand the unique challenges of running a small business. We provide tailored business insurance for more than 500,000 business owners, including tens of thousands of restaurants and other food and beverage ventures.

To better understand the biggest pain points and opportunities for small restaurant owners right now, we analyzed anonymized NEXT data related to revenue, payroll and employee headcount from 30,000 small business restaurants.

We also compared this to third-party cost-of-living data to provide restaurant owners and employees with added financial insight.

Continue reading to learn the real numbers behind the macroeconomic pressures small restaurants are facing; how your restaurant measures up against your peers in terms of revenue, payroll and employee headcount; and tips to help ensure the financial security of your business.

For additional insights into how small restaurants are faring, you can check out our restaurant insurance claims report “How to protect your business from the most common and costly insurance claims.”

Jump ahead to key findings and expert tips:

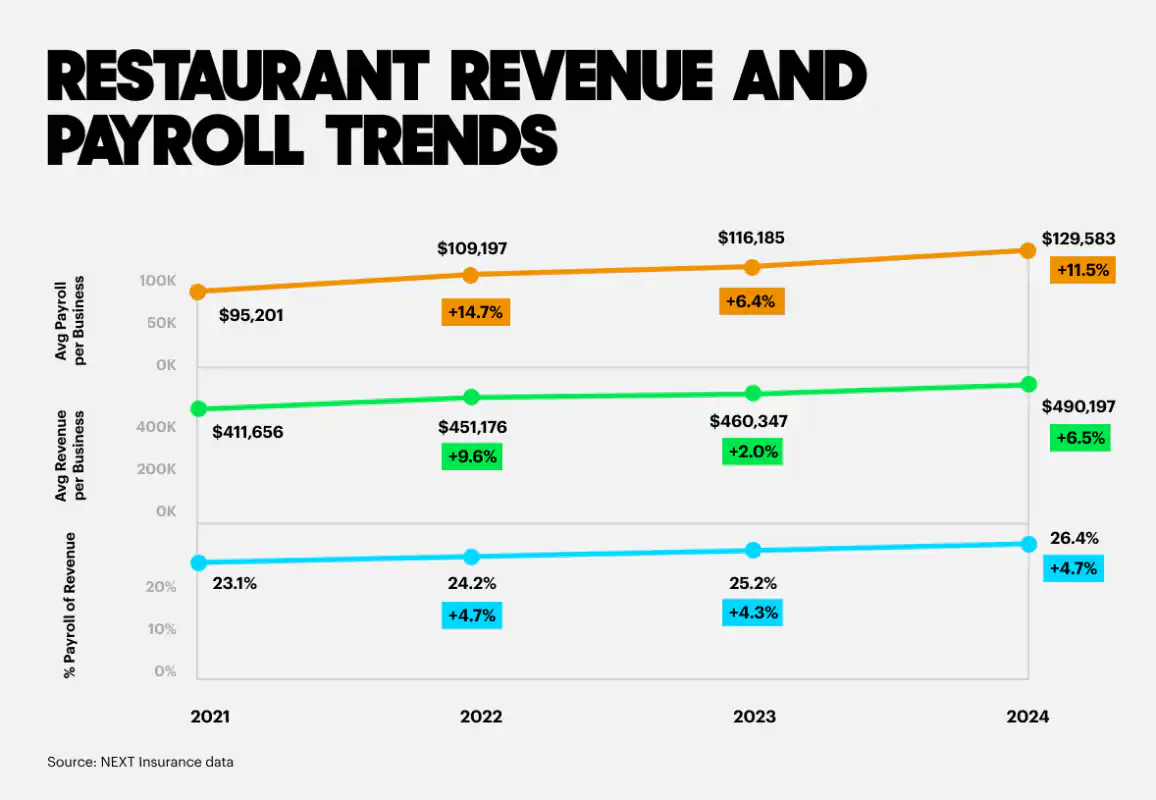

- Restaurant payroll outpaces revenue growth

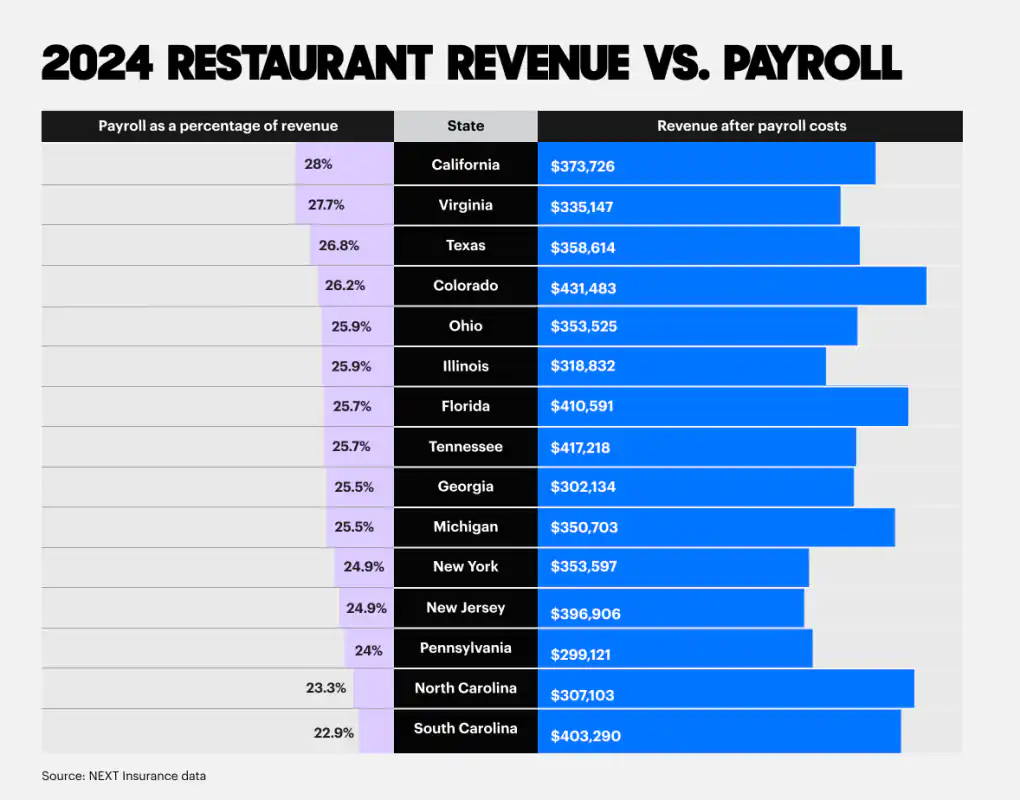

- Industry revenue averages and opportunities to increase revenue

- Industry payroll averages and tips to control payroll costs

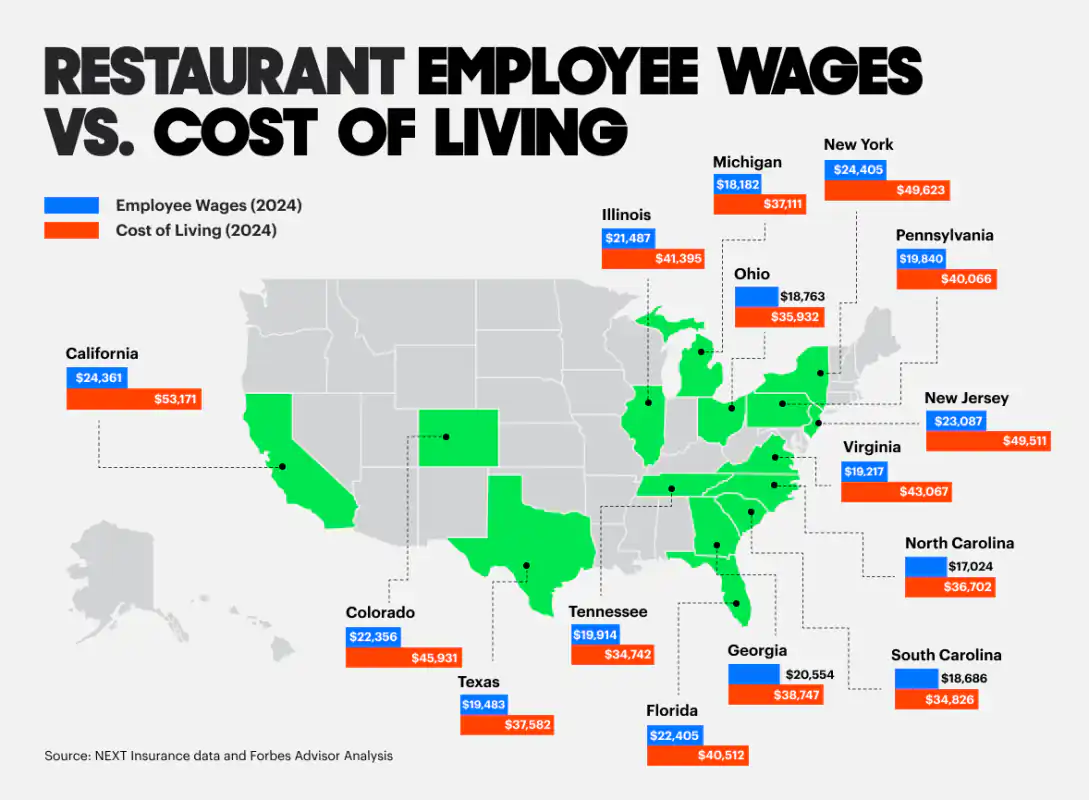

- Employee wages aren’t keeping up with the cost of living

- Retaining restaurant employees in a tight labor market

- Restaurant outlook and next steps