Fire. Equipment breakdown. Employee injury. Assault and battery. The day-to-day risks and threats restaurant small business owners face can feel never-ending. Watch this to learn how to protect your restaurant from its biggest risks:

How to protect your restaurant business from common and costly insurance claims. Insights from NEXT data.

At NEXT Insurance, we understand the unique challenges of running a restaurant. We provide tailored business insurance for more than 600,000 business owners, including tens of thousands of restaurants and other food service entrepreneurs.

We analyzed anonymized NEXT claims data to better understand their biggest risks and concerns. Continue reading for the most common and costly risks that restaurant owners face and how to protect your business.

And for more restaurant insights into revenue, payroll and employee headcount, check out our other recent report: How can restaurant owners manage recent revenue and payroll trends? Insights from NEXT data.

Jump ahead to key findings and expert tips:

How to prevent the most common restaurant insurance claims

What are the risks you need to be aware of as a restaurant owner?

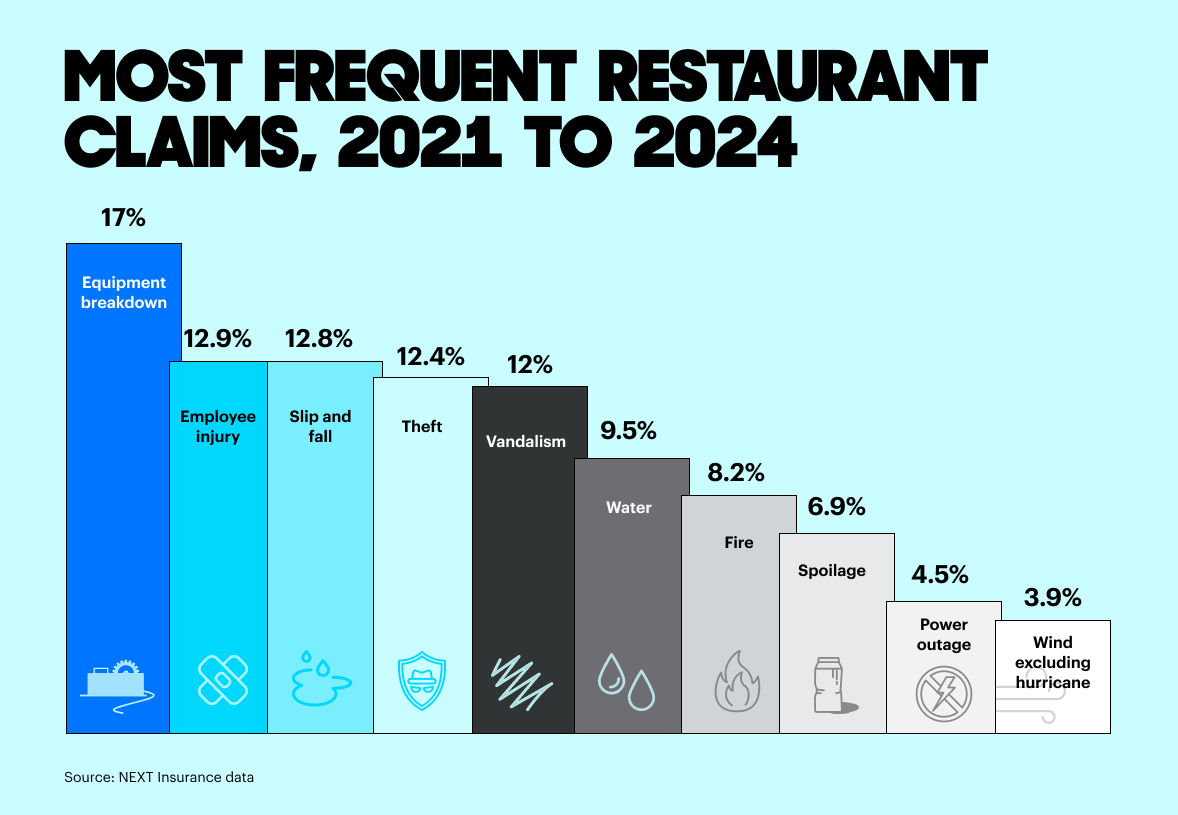

Using NEXT data from claims related to common types of business insurance (general liability, commercial property and workers’ compensation), we identified the most frequent causes of claims.

Knowing this information can enable you to identify your biggest risks as a restaurant owner and take steps to avoid them. From 2021 to 2024, the most frequent claims for restaurants are:

- Equipment breakdown

- Employee injury

- Customer slip and fall

- Theft

- Vandalism

- Water damage

- Fire

- Food spoilage

- Power outage

- Wind (excluding hurricanes)

About 45% of the most common claims fall under commercial property insurance, but it’s good for restaurant owners to cover all of their bases when it comes to coverage.

One option to consider is a business owner’s policy (BOP insurance), which combines commercial property coverage with general liability insurance into one package that is usually less expensive than buying the coverage separately.

Let’s dig into the four most common claims and how to reduce your risk in these specific areas.

1. Equipment breakdown

Claims related to equipment breakdown can be a result of equipment failure, lack of regular maintenance and human error.

With such a wide scope of causes, it makes sense that equipment breakdown is such a common claim. Unfortunately these sudden and accidental malfunctions to business property and equipment can happen more often than expected.

Not only does equipment need to be repaired or replaced, but equipment breakdown can also lead to loss of income and inventory.

Fortunately, there are some steps you can take to reduce your risk in this area:

- Schedule routine maintenance for all kitchen equipment to ensure everything is in good working condition.

- Keep a maintenance log to track service dates and any repairs made.

- Train staff on properly using and handling all equipment to minimize misuse and prevent breakdowns.

- Consider commercial property or tools and equipment insurance to protect your gear.

2. Employee injury

The next most common claim is employee injury. Private industry employers reported 2.8 million nonfatal workplace injuries and illnesses in 2022, according to the U.S. Bureau of Labor Statistics.

Employee interactions with hot food, open flames, wet surfaces and sharp knives are nearly constant with back-of-house staff at many restaurants.

However, there are steps you can take to reduce the risk of employee injury:

- Supply your employees with safety training and equipment.

- Rotate tasks that involve repetitive movements, like chopping or stirring, to reduce the risk of repetitive-use injuries.

Make sure you have the right workers’ compensation insurance in case an incident happens (this is required by law in many states if you have employees). And familiarize yourself with the claims process.

3. Customer slip and fall

In addition to being one of the most common claims, customer slip and fall injuries are also one of the most costly claims (see the next section on the most expensive claims).

If a customer slips on a wet mat and breaks their arm, this can lead to medical expenses and legal costs that could impact your bottom line.

Fortunately, there are some best practices you can adopt to help reduce the chance of these types of accidents:

- Implement a strict cleaning schedule to ensure floors are regularly mopped and dried, especially in high-traffic areas.

- Use anti-slip mats in areas prone to spills, such as near sinks and beverage stations.

- Place visible signage to warn customers (and staff) of wet floors or other temporary hazards.

- Encourage staff to promptly address and clean up spills or other hazards as soon as they occur.

Consider general liability insurance, which can offer financial protection if a slip-and-fall accident happens.

4. Theft

Stolen inventory, equipment and property. Shattered windows, busted doors and broken locks. When a criminal steals from your restaurant, you take a hit financially but also emotionally.

To avoid the financial burden and stress, here are some practical steps to prevent theft claims:

- Install security cameras throughout your restaurant, focusing on entry points, cash registers and storage areas.

- Use alarm systems and secure locks for all doors and windows.

- Implement strict cash handling policies, such as regular cash drops to a secure safe and limiting the amount of cash in registers.

- Train staff to be vigilant and report any suspicious behavior immediately.

- Consider commercial property insurance or a business owner’s policy (BOP) so you have a financial safety net in case you experience theft.

Preparing for the most common restaurant insurance claims regionally and seasonally

By knowing the biggest threats to your restaurant — seasonally and geographically — you can better navigate these risks and create a more resilient business.

Depending on the state where you do business, we see a wide range of most frequent claims.

For example, the top claim for Pennsylvania is equipment breakdown, for Florida it’s employee injury and for California it’s vandalism. In both New Jersey and Tennessee, the top claim is for fire. Mississippi’s top claim is for wind, excluding hurricanes. In Michigan, it’s spoilage claims. And in Virginia, it’s power outages.

Our data also shows seasonal trends for property-related claims:

- Hurricane claims peak September to November.

- Water damage claims are most frequent December to February.

- Hail, tornado and wind (excluding hurricane) claims are most common March to May.

- Power outages and lightning claims are most frequent June to August.

Though these trends are seasonal, many restaurant owners still find themselves unprepared year after year.

According to a NEXT survey of restaurant owners, 48% reported winter weather-related damage, and yet over half of respondents admitted to not feeling adequately insured.

Tips to reduce seasonal risks:

- Invest in preventative measures. For example, inspect your roof and repair any weak spots before winter. And back up restaurant data so you don’t lose anything important in a storm.

- Review your coverage to identify coverage gaps and make adjustments as necessary to avoid being underinsured.

- Consider commercial property insurance for financial protection.

How to reduce risks from the most costly restaurant insurance claims

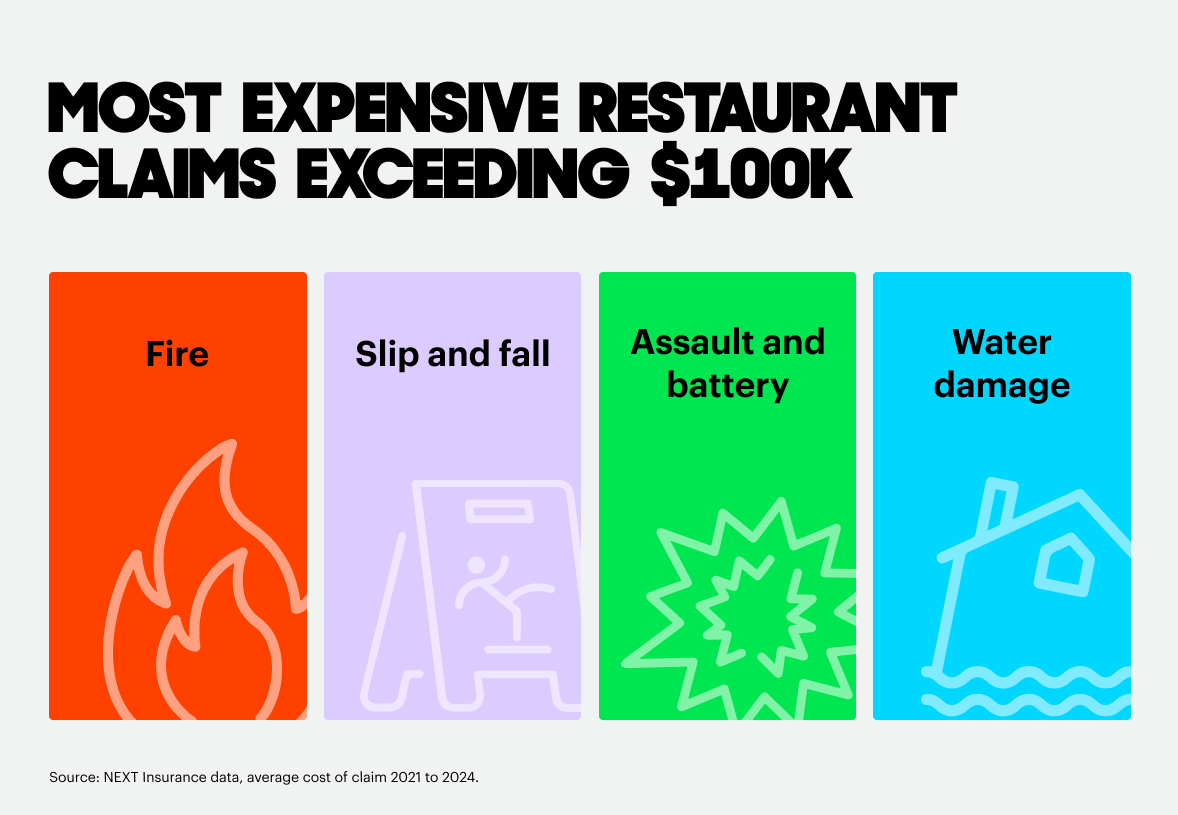

Some individual claims are more costly than others, regardless of frequency.

According to NEXT data from 2021 to June 2024, restaurants with a business insurance claim had an average total loss of around $9,000. Fine dining restaurants take the biggest loss per business with average claims nearly double of all restaurants.

If you don’t have the right business insurance, paying out of pocket could put a small restaurant out of business. That’s why it’s so important to have coverage, even for less obvious risks that you may have never considered.

“Running any small business involves risks,” says Chris Rhodes, Chief Insurance Officer at NEXT. “That’s why it’s so important for small business restaurant owners to understand the most common threats and their associated costs.”

The top four most expensive restaurant claims from 2021 to 2024, according to our data, are fire, slip and fall, assault and battery, and water damage.

Fortunately, there are ways to mitigate the risk of these expensive claims. Here are some tips for reducing risk in these specific areas.

Fire

While fire comes in at the number seven spot in the list of most common restaurant claims, it ranks as one of the most costly business insurance claims.

Fortunately, there are a lot of proactive steps you can take to reduce the risk of fire at your restaurant:

- Regularly inspect fire prevention supplies like extinguishers, alarms and sprinklers.

- Train employees on fire suppression equipment and fire exits — and practice fire drills.

- Clean equipment regularly (or have it cleaned).

- Consider commercial property, general liability or business owner’s policy (BOP) coverage in case of fire.

Assault and battery

Assault and battery claims are related to threats of harm or the actual physical act of harming someone. Sounds scary — and, as a restaurant owner responsible for the safety of your employees, customers and property, it can be.

But there are steps you can take to mitigate the risk of facing an assault or battery incident in your place of business:

- Implement a security program, which can consist of both technology solutions — like surveillance cameras — but also no-tech safety measures like security patrols.

- Offer risk-awareness training that helps your staff recognize warning signs that can lead to violence.

- Create a crisis plan to document what to do in the case of any incidents.

- Provide de-escalation training.

- Consider general liability insurance and workers’ compensation insurance to protect your customers and employees, respectively.

Tips for filing a claim to ensure a speedy payout

The good news? Many costly claims can be prevented. With a little planning, preparation and a proactive approach, you can protect your businesses, employees and customers.

The bad news? Mishaps do happen, and sometimes an insurance claim is unavoidable. It’s important for restaurant owners to be prepared.

Consider creating a risk management plan and buying a tailored business insurance package for your potential risk exposure.

“Filing an insurance claim can be daunting, but there are simple steps business owners can take to resolve the issue quickly,” says Rhodes.

Tips for a smooth claims process:

- Familiarize yourself with your insurance coverage so you’re prepared for an incident.

- If you experience an incident, contact your insurance provider immediately so they can partner with you to resolve the claim quickly.

- Assess and document damage with photos and notes.

- Work closely with your claims adjuster and respond to their questions promptly.

With the right understanding of your biggest threats and the right coverage, customized for your business, you’ll be better able to withstand the ups and downs of restaurant ownership.

Learn more about the claims process at NEXT.

Get an instant quote to see what coverage you need for your restaurant and how much it would cost.

About NEXT Insurance

We’re NEXT, an insurance company that only focuses on providing fast and customized business insurance for entrepreneurs.

That means we can provide you with top-quality insurance options and dedicated claims advocates that protect you from the unique risks your business faces every day. If you need help, our small business experts are ready to support you from start to finish.

See why more than 600,000 small businesses from 1,300 professions turn to NEXT to get the protection they need.

Start a free quote online today.

Methodology

This report contains anonymized data from more than 30,000 small businesses that purchased insurance from NEXT. Restaurants are defined as one of three types: quick service, casual dining and fine dining.

All insurance claims research is from NEXT’s claims data, January 2021 to July 2024.

Forward looking statements disclaimer

This report contains forward-looking statements that involve a number of risks, uncertainties and assumptions, including but not limited to statements regarding the expected growth and trends of restaurants. Any statements that are not statements of historical fact may be deemed to be forward-looking statements, and actual results could differ materially from those stated or implied in forward-looking statements.

This report also includes market data and certain other statistical information and estimates from industry analysts and/or market research firms. NEXT believes these third party reports to be reputable, but has not independently verified the underlying data sources, methodologies or assumptions. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and may differ materially from actual events or circumstances.