One of the most important roles of the CEO is to raise money. Are you investing enough time in this task to be sure you’re doing it well? Like most things in life, hard work and thoughtful preparation can greatly increase your chances of success. Much has been written on raising money, so I will change focus, and try to share with you the “How": How can you create a process that will increase your chance for a successful outcome?

I’ve used this process seven times, and all but one ended up with successful funding.

Getting Started

When you set out to raise money, you will find yourself in one of the following situations:

- Easy to raise money: your company is in a huge space, all your charts are up and to the right and you are not looking for high valuation; or

- Moderate difficulty to raise money: this is your Seed or A round and you have a solid background, you might come from a top college, have been in a senior role in a hot, relevant company or have successfully sold a company in the past; or

- Really difficult to raise money: you have none of the above.

When I was CEO of Check, Inc, until 2014, I always found myself in situation ‘C’ and it was never easy.

Project Plan

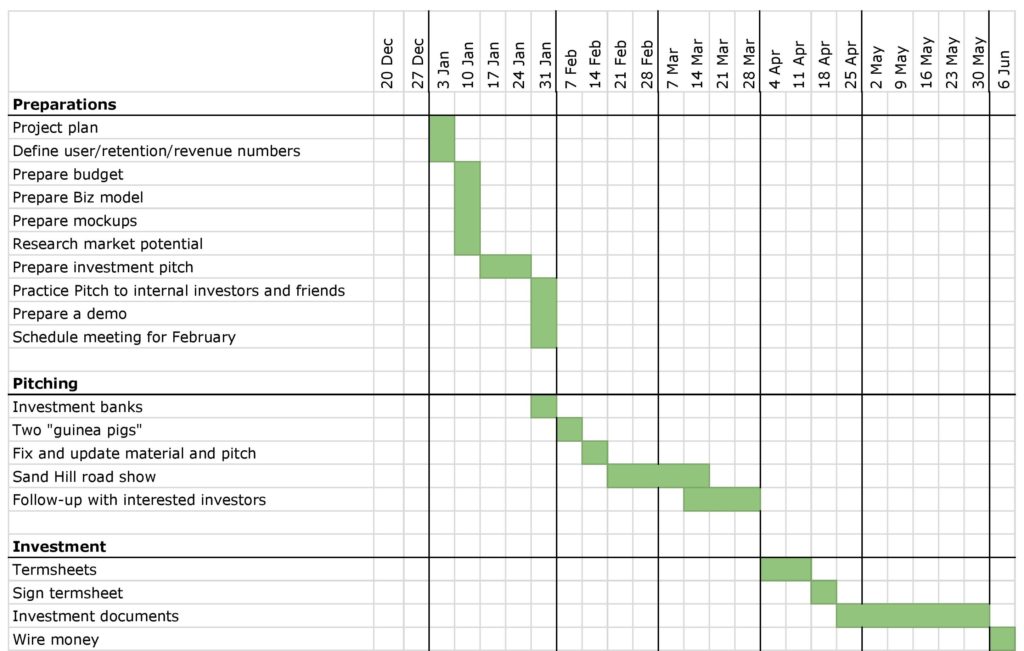

Raising money is a project. Like any project, it has a list of tasks and a timeline. I used this spreadsheet to manage my project:

The plan has three main steps: preparation, pitching and investment.Let’s say you want the money by June. You then need to work backwards and plan when you need to start in order to achieve your goal. You should plan for the worst and assume the entire process will take you five months. If things go well, the time between first pitch to signed term sheet can be shorter, but it is rarely less than a month.

Preparation

Preparation is the most important part. Invest the time to do prepare properly. If you put most of your energy and time into your preparation, you can prepare a good pitch in one month. This is not a task to do overnight. The components you need to create include:

Pitching Material:

This refers to the entire material set that is needed for the actual presentation. It includes the following:

- Market analysis, including market size, competition, and which segments of the market are relevant to you.

- Business model: I created a very detailed model for 2-3 years out. It includes the bottom-up revenue model and the key assumptions. It also includes a very detailed expense model. I had around 10-15 sheets in my model. Having such a model upfront will give you a lot of confidence in the numbers, both on revenues, as well as how you are going to use the funding.

- Demo and mockups: I used to have a ready flow which worked on demo data. So every time I showed it, it was exactly the same. In our case, since we used a lot of real time data (weather is an example of real time data), R&D had to develop new functionality to make sure we always used demo data instead of real-time data . I didn’t want to have any surprises during the meetings (in the weather example, what if your script assumes a sunny day, and in the meeting, if you use real time data, it suddenly starts to rain? Demo data avoids this potential pitfall.).

- Metrics about your company: graphs and data of all the important KPIs that represent your company.

- The investor deck: this is a hot topic all by itself, and a lot has already been written on that subject.

The “Performance”:

I treated the investor meetings as my version of a Broadway show, and prepared that way. I know a lot about my company, but I only have 40 minutes, during which time I need to convey all appropriate knowledge and make sure an investor will understand it. I’m not talented enough to ad lib at the last minute, so I prepared well in advance. I wrote a script of of what I’m going to say, word for word. My partner, who joined me in the investor meetings, also had a part, which was scripted as well.He added comments at specific times during the pitch; for an audience, they would look spontaneous, but were all staged and planned in advance. Once I had the perfect script, I practiced until it stopped sounding less as if I was reading from a teleprompter and more like a confident CEO who knows what he’s talking about. When the entire company future depends on my success to raise money – it’s better to be safe than sorry. More preparation is always better.

Friendly Pitches:

Once you’re ready, start pitching to your friends and colleagues. It’s better to find friends who have heard or prepared pitches in the past, as they will offer you the most useful feedback.

Questions and Answers:

You will be getting many of the same questions in every meeting, so you should try to anticipate them and make sure your answers are ready in advance. I used to prepare a list of potential questions. Then I crafted the answers and practiced them, the the same way I worked on the pitch itself. During the pitching to investors, new questions came up sometimes. When that happened, I made sure to add the new questions to my Q&A sheet for use in future meetings.

Follow-up Meeting Material:

Once you start speaking with investors, if someone is interested, they will want to learn more, and will ask for more information. At that moment, you will not have time to prepare it, so you need to prepare it in advance and there’s no time like the present. An investor will want to drill down and delve deeply into each one of your slides:Why is your market is as you describe?, More depth and more data on the KPI etc... For our case, I used to prepare a spreadsheet with all user data, user cohorts, acquisition channels, marketing ROI, activation and more. I tried to anticipate and prepare anything I thought an investor might want.

Due Diligence Material:

After a term sheet is signed, an investor will do a more thorough business, legal and financial diligence check. I would recommend waiting with this until you have a signed term sheet. You will have time during the drafting of the definitive agreement to prepare all of it.

Investor List:

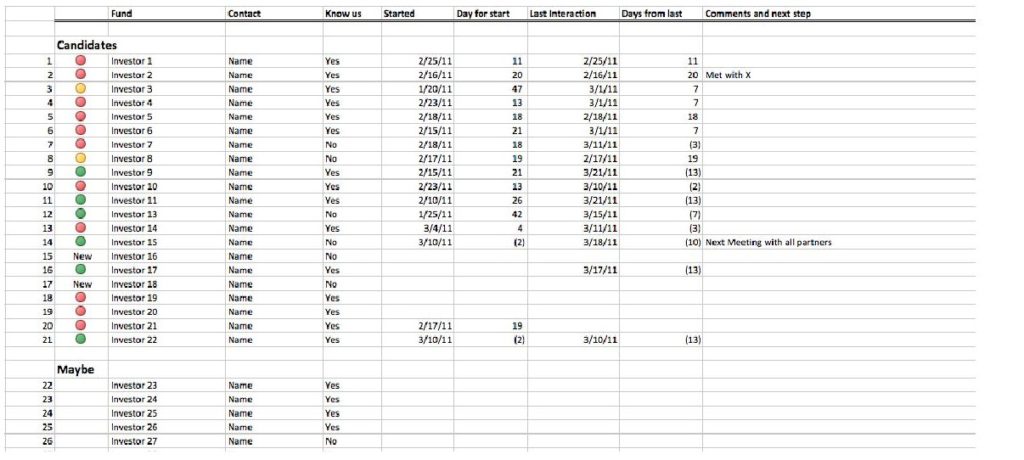

Prepare a targeted investor list and create a dashboard to track the status of each investor you are interested in. Try to set two “guinea pig” meetings early on; these are meetings where you are mainly focused on trying out your role and less on actually getting funding. Two weeks after those, schedule all the rest of the meetings. Try to schedule all the meetings over a period of two to three weeks. I used a spreadsheet with the following legend: * Red: I got a ‘no’ or more than two weeks since I heard back * Yellow: I haven’t heard from them for more than a week * Green: I’m still in contact with them and haven’t heard a “no”.

My dashboard starts with all green – why not start optimistically? I also tracked who I spoke to, when was the first interaction, how long has it been since the last interaction, and comments and things I need to prepare to follow-up with them, by phone, email or a meeting. This is what it looked like:

Pitching

Once you are done with all your preparation, it’s time to let the show begin!

“Guinea Pig” Pitches:

Pick two investors who do not know your company – it is very important that they never heard about you, otherwise will be difficult to get the maximum value from these meetings. Select investors who you think have a low likelihood of investing in you, or you are not especially interested in, or just sacrifice two potential investors. The idea behind the “Guinea pig” meetings is to learn if your message is understood, get more Q&A and learn what the objections are to your pitch/product/company. These meetings should take place two weeks before the road show so you have enough time to make significant fixes from what you learn. I found this step to be critical in the raising process. No matter how much you prepare and pitch to friendly investors,once you meet someone who does not know much about your company, suddenly you figure out that there are areas where your pitch is not clear and messages that are not getting through.

Road Show:

This is it; you are ready! Now you are having 2-3 meetings a day, pitching to many investors. You will find out that all these meetings are largely the same. So if you prepared well, you will rarely be surprised. I hope you are confident in your company, and what you can do; make an effort to show your enthusiasm in these meetings. One other important note is that this can be an emotionally difficult time, for two reasons. Firstly, this process is very important for you and your company and the stakes are high – it can feel like a live or die situation. Second of all, you are mostly getting ‘no’ after “no” and it’s not easy to get so many rejections. Try to bear in mind what my old chairman always told me: “You only need one to say yes”.

Iterate:

You learn a lot from every meeting and investor, including the ones that end with a rejection. You can be arrogant and dismiss the declines by saying that the investor doesn’t understand, or you can take the opportunity and learn. Try to get as much information as possible to understand why an investor decided not to invest, and then try to modify your story to resolve those concerns. Sometimes, your company is not ready to raise money yet; this happened to me once. If you get a ‘no’ from everyone, my recommendation would be to try to get some bridge funding to survive a few months and make sure you fix what needs to be fixed to raise your round on your next effort.

Follow-Up with Investors:

As mentioned above, if you get some interest from an investor, they would most often like to learn more about you and your company, and they will ask for more material. Since I always prepared this material in advance, once I got those requests, I would be able to get back to the investor within one or two days,with well-prepared and organized materials. Not only do I think it gives your company more points for being fast and organized, it also accelerates the process and creates a sense of urgency to drive the deal to a close. If the deal does not progress and you do not have multiple interactions with the investor over a period of one to two weeks, it’s probably not moving forward.

Investment

If you did all the preparations and were confident during your meetings, I hope you will get a term sheet. There is still a long process between getting a term sheet and signing a definitive agreement, which I will not cover here, but know that now your chances of closing the deal at this point are very high.

The process of raising money takes lot of time and energy, but if you put the necessary time and effort into it, you are significantly increasing your chances of success.