According to NEXT data report analyzes small business restaurant payroll, wages & claims severity across the U.S.

PALO ALTO, Calif., September 24, 2024 — Today, NEXT Insurance, a leading digital insurer transforming small business insurance, for the first time, announced new proprietary data focused on the restaurant sector, highlighting insights from over 30,000 small business restaurant owners across the U.S. The report, which analyzes revenue and payroll trends as well as the most common and severe insurance claims in the restaurant industry, reveals a nuanced landscape: While restaurants have seen a substantial recovery over the past four years with rising revenues, they continue to face significant challenges from macroeconomic pressures such as increasing payroll costs and ongoing inflation. These factors exacerbate the strain on an industry known for its tight profit margins.

"With restaurant sales projected to hit record highs this year and the restaurant industry being one of our core customer groups, we recognized an opportunity to explore how restaurant owners are navigating this period of growth and heightened demand,” said Effi Fuks Leichtag, Chief Product Officer at NEXT Insurance. “By analyzing a four-year snapshot of our restaurant data, we’re able to uncover trends that not only aid in risk assessment but also empower small businesses to plan for growth and future success. While our focus for this report is on restaurants, we aim to extend these valuable insights to other industries and the small business landscape as a whole, reinforcing our commitment to being a trusted partner for our customers."

Key insights from NEXT’s restaurant report:

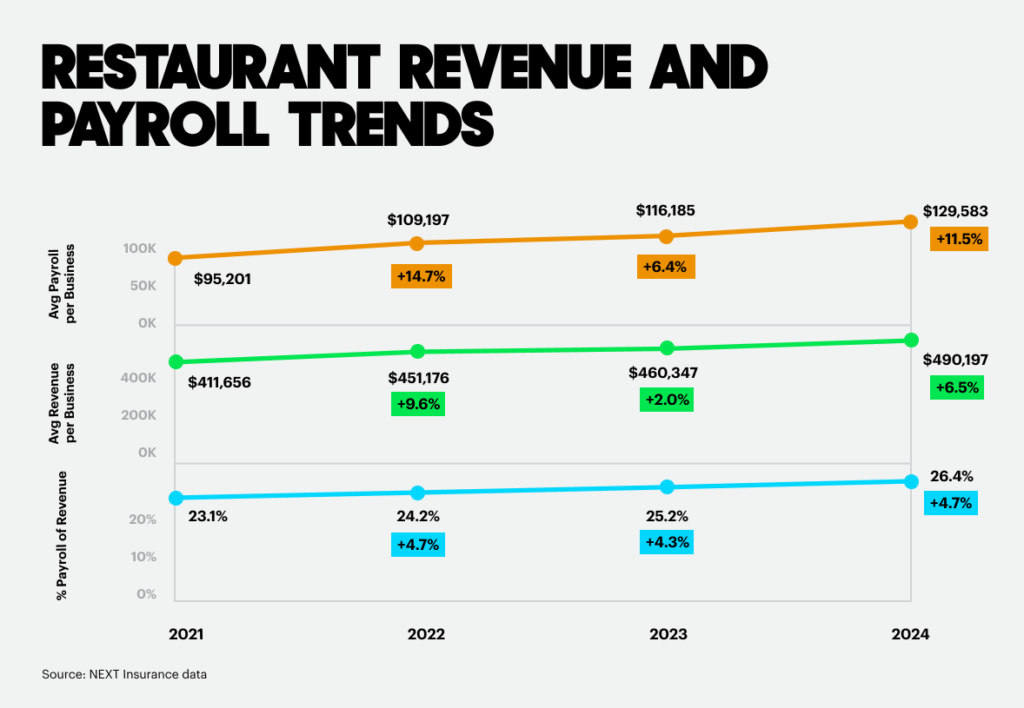

Restaurant payroll is growing faster than revenue.

- Restaurant revenues increased on average 6% annually since 2021.

- Average 2024 restaurant revenue is $490,197, up 19% from 2021.

- Payroll has risen, on average, 10.9% annually since 2021.

California and Colorado restaurants face the highest payroll costs.

- Payroll costs make up over a quarter of restaurant revenue nationwide, with California and Colorado hit the hardest.

- Colorado leads the U.S. in payroll expenses, averaging $153,220 per business. However, it also has the highest average revenue after payroll expenses at $431,483.

- California has the highest payroll percentage of revenue at 28%.

- In California, vandalism is the top claim filed, while theft is one of the most frequent nationwide.

- Water damage claims are most frequent from December to February, while power outages and lightning claims are most frequent from June to August.

- Fire, customer slip and fall, assault and battery, and water damage are the most severe claims that can exceed $100K.

Visit the NEXT Insurance blog to read the full report and get a detailed analysis of the findings and tips for small business owners on navigating these challenges.

If you're interested in becoming an appointed agent or exploring embedded partnership opportunities through our industry-leading digital solution, NEXT Connect, click the links for more details.

About the Report:

This report contains anonymized data from more than 30,000 small businesses that purchased insurance from NEXT. Restaurants are defined as one of three types: quick service, casual dining and fine dining.

Payroll and revenue data are derived from user-supplied projections submitted within NEXT applications from January 1, 2021, to December 31, 2024.

Regional data was selected based on the states with at least 150 NEXT customers and then ranked on payroll and revenue.

All insurance claims research is from NEXT’s claims data from January 2021 to July 2024.

About NEXT Insurance:

NEXT Insurance is a leading digital insurer transforming small business insurance with simple, digital coverage tailored to the self-employed. Trusted by over 500,000 business owners, NEXT offers policies that are easy to buy and provides 24/7 access to purchasing and servicing, including Certificates of Insurance, additional insured, and more, with no extra fees. Revolutionizing a historically complicated insurance industry, NEXT utilizes AI and machine learning to simplify the purchasing process. Founded in 2016, the company is headquartered in Palo Alto, has received over $1 billion in venture capital funding and has been recognized by CNBC Disruptor 50, Forbes Fintech 50, Inc.'s Best-Led Companies, and Forbes Best Startup Employers. For more information, visit NEXTInsurance.com. Stay up to date on the latest with NEXT on Twitter, LinkedIn, Facebook and our blog.

Media Contact

Kerry Ogata

Director of Corporate Communications

301-717-4224

kerry.ogata@nextinsurance.com