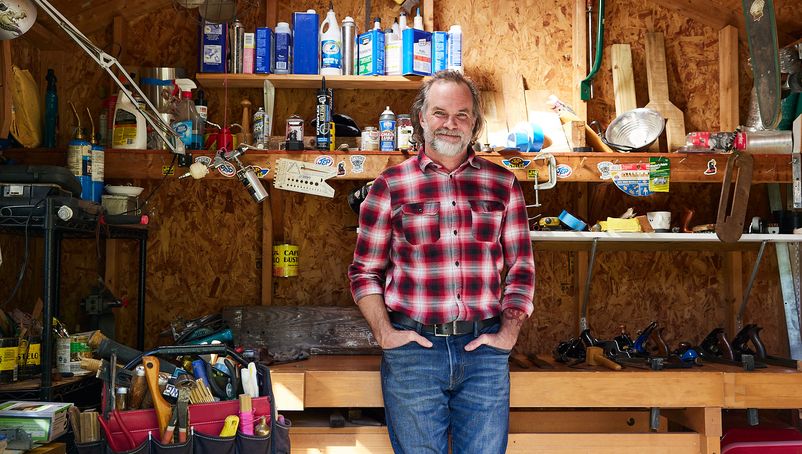

How I got into contracting

Growing up, I didn’t plan on being a contractor. I had a lot of energy, spent a lot of time outside or making weird little contraptions. After I graduated from Virginia Commonwealth University with a degree in sculpture, I needed to find something to do, and carpentry just seemed to make sense.

There was something about shaping raw materials and seeing a vision come to life in real time that hooked me. It’s definitely a journey. I learned on the job, working with older carpenters and tradespeople who had a lot of wisdom to share.

Over the years, I built a reputation as someone who could take on challenging projects, whether it was stairbuilding, replicating an antique piece of furniture or building a custom set of barn doors.

The day I got robbed — and lost a crucial piece of equipment

I was working on a quick project one morning. I had gotten to the job site early, just me and the job ahead of me. It wasn’t anything too complicated; it was just a basic job that I figured would take a few hours. I had my hand and power tools and I was ready to go. It was in sort of a sketchy neighborhood, but hey, that’s part of the job. I go where I’m needed.

Out of nowhere, a man approached me.

He started talking fast, asking questions, offering help. I wasn’t suspicious at first — just another person asking if they could lend a hand. I didn’t realize what was happening until it was too late.

When we went inside the building to confer with the homeowner the guy doubled back, swiped a chop saw from the back of my truck and hauled ass.

It wasn’t until I was setting up all my contractor tools that I needed that I noticed this particular power tool was gone. Talk about a sinking feeling. Here I was, on a small job I was trying to knock out quickly, and one of my main tools — the lifeblood of my business — was gone.

Having my chop saw swiped wasn’t just an inconvenience. It was a real problem.

But instead of dwelling on it, I do what I always do when a job goes sideways — I adapted quickly and was able to complete the project with a different piece of business equipment: my trusty circular saw. Telling myself I’d deal with it later, I got the work done, packed up and headed home to let off some steam.

Figuring out my equipment insurance policy and filing my claim

The next day, I sat down and thought about what had happened. I’d never had to reach out to an insurance company to file a claim like this before.

To be honest, I wasn’t sure how it worked, what my policy would cover or what to expect.

My business is insured by NEXT Insurance, with my insurance needs met with two insurance policies: general liability and tools and equipment insurance.

So, I hopped online and went to the NEXT’s website to file my claim — and to see how my equipment insurance coverage would work.

I found the claim section, and before I knew it, I was filing my claim with just a few clicks. No complicated forms, no having to figure out my type of coverage and no waiting for days. Just a simple process that made sense.

Navigating the whole process was way easier than I thought it would be.

The next step was a little nerve-wracking. Would they come through for me?

I didn’t want to waste time waiting on an approval and was worried about dealing with financial loss. But to my surprise, the entire process was smooth and straightforward. The business insurance claims team at NEXT was responsive and professional. They helped me through everything, including providing details on what my equipment insurance covers and how I would be reimbursed.

I didn’t have to chase anyone down or explain myself over and over. They took care of the paperwork, confirmed the details of the theft and made sure I was properly covered for the replacement cost.

It was a huge relief to know that thanks to my insurance coverage, I wasn’t going to have to replace that saw out of my pocket.

Just as importantly, I wasn’t going to lose time, which is a big deal for a small business owner like me.

NEXT small business insurance made a difference

I’ve been in this business for a long time. I’ve seen the ups and downs, the good and the bad, and I’ve learned a lot along the way.

One of the most important things I’ve learned is how crucial it is to have the right support when you need it. Whether it’s helping a client with a design challenge or working with an insurance company to handle an insurance claim, having the right people on your side makes all the difference.

With NEXT, I never felt like just another account number. The customer service was top-notch and made business insurance feel personal. At the end of the day, NEXT took as good of care of me as I do with the old houses I’m always tinkering with.

This made a huge difference, especially when it came to my peace of mind. I didn’t have to stress over the details; I could keep my focus on what I do best — working on the job and taking care of my client.