A multinational software company with a leading online payroll product for small businesses wanted to enable customers to purchase workers’ compensation insurance within their digital experience. They chose to partner with NEXT to make this possible.

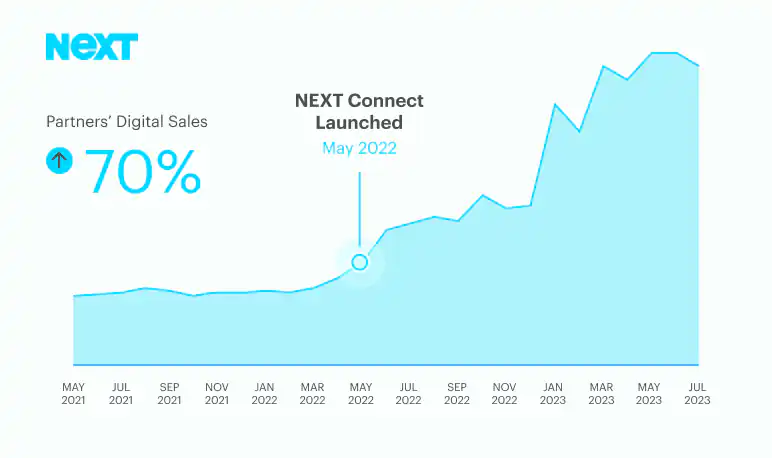

NEXT collaborated with the payroll provider to implement NEXT Connect, our embedded insurance product. This solution allowed the partner to offer workers’ compensation and other business insurance within their native digital environment.

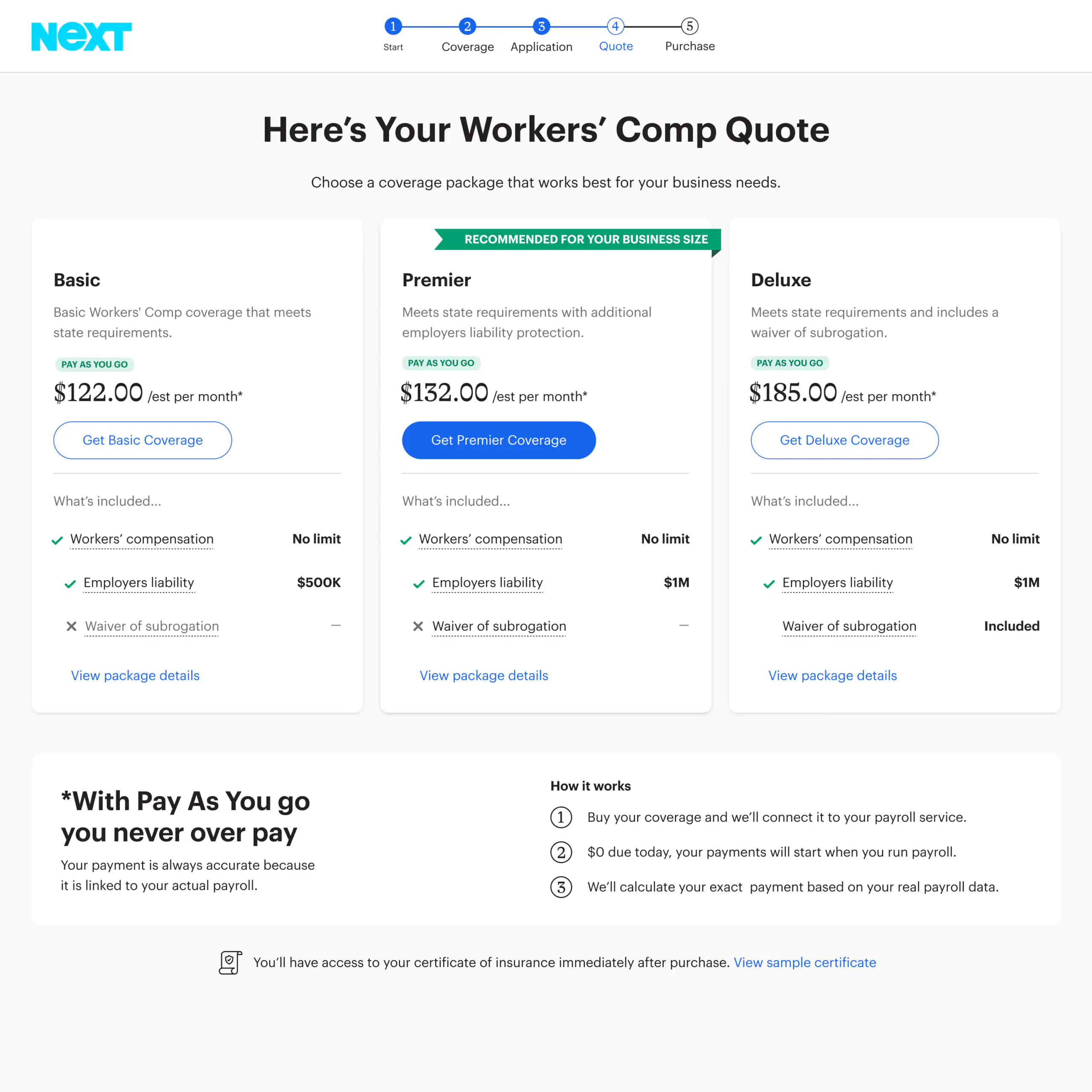

The frictionless, native NEXT Connect experience enabled customers to shop and buy policies from within the partner’s payroll product in minutes. In most cases, they could complete their application and purchase their policy 100% online.

As a result, the partner saw a 70% increase in digital sales of workers’ comp policies.1 Total revenue went up 45%, significantly boosting the partner’s shared earnings from the program.1

And customers were able to get the business insurance they needed easily and more efficiently.

NEXT Connect increases digital addressability and revenue

The problem:

While the leading online payroll provider recognized the value of offering workers’ comp to help ease regulatory compliance for customers, they were referring customers to an external broker for coverage. This process required customers to wait for an agent to contact them, and lack of digital addressability led to reduced sales and revenue.

By 2022, they wanted to enable customers to purchase workers’ comp and other business insurance digitally. Research that year indicated that customer preference for online experiences was at 65%, up from 33% only two years earlier.2